Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

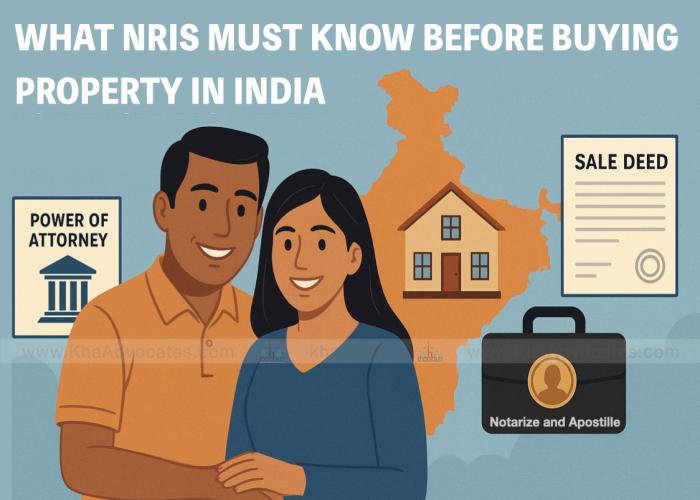

For Canadians holding an Overseas Citizen of India (OCI) card who want to invest in Indian real estate without physically travelling to India, the question is common:👉 Can you buy property through a Power of Attorney (POA)?👉 What is the exact lawful process?👉 What are the required documents, legal risks, and government rules?This guide answers these questions in simple language — but with professional legal precision — so you and your family can make informed, compliant investment decisions in Indian property law.Can an OCI Card Holder Buy Property in India Without Coming to India?Yes — Generally, YesAs per Indian law under the Foreign Exchange Management Act (FEMA) and its Rules (especially Foreign Exchange Management (Non-Debt Instruments) Rules, 2019), an OCI card holder is legally allowed to:✅ Purchase residential & commercial property in India❌ Except agricultural land, plantation property, or farmhouses (unless inherited) Under FEMA Section 5 & Section 46, OCIs enjoy general permission to acquire immovable property without prior approval of the Reserve Bank of India (RBI), provided all payments are made through permissible banking channels. 📌 Important Legal Foundation📜 1. FEMA 1999 & Non-Debt Instruments RulesContains the core rules on foreign acquisition and transfer of immovable property.OCIs fall under the permitted class (similar to Non-Resident Indians (NRIs)).Purchase of residential or commercial property requires no RBI approval; agricultural-related property does. 📜 2. Transfer of Property Act, 1882Governs how property rights can be transferred through sale deeds, wills, or POA.Under Section 5 & Section 54 (Definitions) it recognises valid conveyance through registered instruments. 📜 3. Indian Registration Act, 1908All instruments dealing with immovable property (including sale deeds and POA) must be registered at the local Sub-Registrar’s office for legal effect.Notarised but unregistered POA is legally ineffective as a transfer instrument. Can a POA Be Used to Buy Property Without Physical Presence?Yes — But Only If Done Correctly.A Power of Attorney allows your appointed representative in India to act on your behalf for specific property dealings including:➡ Identifying property➡ Negotiating price➡ Signing the sale agreement➡ Executing the sale deed➡ Attending registration formalitiesBut there are legal requirements:1️⃣ Special/Specific Power of Attorney (SPA)a. Must be carefully drafted to clearly list powers — e.g., negotiation, signing agreements, registration, tax payments.b. A general POA is insufficient for property purchase. 2️⃣ Attestation/ApostilleIf executed outside India, the POA must be:a. Notarised in Canada (or local state)b. Then either:✔ Apostilled (if Canada is Hague member), or✔ Attested by the Indian Consulate/EmbassyThis ensures Indian authorities accept it as authentic. 3️⃣ Registration in IndiaThe POA must be:📍 Registered with the Sub-Registrar Office where the property is located📍 Paid applicable stamp duty (state-specific)Note: A notarised POA alone — without registration — is not legally effective to deal with property. 🧭 Step-by-Step Process to Buy Property via POA (Canadian OCI)This process helps you purchase legally and securely without traveling:🔎 Step 1: Identify the Propertya. Confirm seller’s titleb. Conduct title and encumbrance searchc. Ensure no litigation or fraud history‼ This is where legal due diligence done by an expert law firm like KHA Advocates protects you.🖋️ Step 2: Draft and Execute Power of AttorneyYour Canadian OCI must:✔ Choose the attorney (trustworthy person in India)✔ Draft a specific SPA✔ Notarise it in Canada (state)✔ Apostille/Consulate attestation✔ Ship properly sealed to India✔ Get it registered locally with stamp duty paid📌 POA must be time-bound, specific & covers registration authority.💸 Step 3: Arrange FEMA-Compliant PaymentPayment for property must follow FEMA guidelines:✅ Through inward remittanceOR✅ From your NRE, NRO, or FCNR(B) account❌ Cash/Foreign currency notes/Traveler’s cheques NOT ALLOWED. 📄 Step 4: Sale Agreement & RegistrationYour attorney will:1. Sign the Agreement to Sell2. Pay earnest deposit3. Prepare the Sale Deed4. Pay stamp duty & registration fees5. Register the sale deed at Sub-Registrar’s OfficeOnly a registered Sale Deed transfers ownership. — POA itself does not transfer rights legally. 🧾 Step 5: PAN & Tax ComplianceOCI must hold:✔ Indian PAN Card (Income Tax purpose)✔ Comply with TDS requirements (if applicable)✔ File Income Tax return if rental income earnedPAN is essential for registration and taxation. 🏦 Step 6: Repatriation of Sale Proceeds (Future)If the OCI sells later and wants to bring money abroad:✔ Repatriation of sale proceeds is allowed subject to RBI rules and compliance with FEMA and tax laws.📌 Common Legal Pitfalls to Avoid❌ Using a Notarised POA only without registration❌ Ambiguous or blank powers❌ POA not consulate-attested or apostilled❌ Missing PAN or TDS compliance❌ Paying outside permissible channelsYes — a Canadian OCI card holder can legally buy residential or commercial property in India without coming to the country, provided all legal formalities are followed, especially through a registered Power of Attorney and FEMA-compliant payment methods.This method is entirely lawful and widely used, but depends heavily on:✔ Properly drafted, attested & registered POA✔ Clear title & due diligence✔ RBI/FEMA compliance✔ Local Registration complianceWhy Choose KHA Advocates?We specialize in:✔ OCI & NRI Property Transactions✔ Power of Attorney Drafting & Registration✔ FEMA & RBI Compliance✔ Property Title Verification✔ Sale Deed Registration Support✔ Cross-Border Real Estate AdvisoryWe assist clients globally — including Canada, USA, UK, Australia & Middle East.Contact Details :KHA Advocates [Law Firm]Google Location : https://share.google/oFGKBu7PpPPNJalp0 New Town, Hatiara, Dhankal, Noapara, Kolkata, West Bengal 700157📞 Phone: +91-94-777-5-888-5📱 WhatsApp: +91-8010-555-666📧 Email: contact@khaadvocates.in🌐 Website: https://www.khaadvocates.com 🗓 Book Consultation: 👉 https://khaadvocates.com/book-consultation

Read More

Buying or selling a property is one of the biggest financial transactions of life. Yet, many people rush into it without proper legal guidance—only to face disputes, fraud, or loss later. The sale agreement and the sale deed are the backbone of any property transaction. Any mistake in these documents can cost you money, peace of mind, or even the property itself.That’s where a property lawyer plays a critical role. In this blog, we explain why you need a property lawyer for drafting and verifying your sale agreement and sale deed, the risks of not having one, relevant case laws, and how our law firm can help you.Why Are Sale Agreement and Sale Deed So Important?Sale Agreement: This is the preliminary contract that records the terms and conditions agreed upon between the buyer and the seller—price, payment schedule, possession date, default clauses, etc. It sets the foundation for the final sale deed.Sale Deed: This is the final registered document that transfers ownership of the property from the seller to the buyer. It is executed only after all obligations of the sale agreement are fulfilled.💡 Key Point: If the sale deed is not properly drafted and registered, your ownership rights are not legally secure.Common Problems People Face Without a Property LawyerHidden Liabilities – Many properties have unpaid loans, tax dues, or legal disputes. Buyers discover them only after purchase.Defective Titles – If the seller is not the real owner or if the property has multiple claimants, the sale deed can be challenged in court.Unclear Clauses – Vague language in the sale agreement can lead to disputes over possession, payment, or construction delays.Fraudulent Sales – Cases of fake documents, forged signatures, and double sales are common.Registration Issues – Errors in stamp duty, witness details, or registration can render the deed invalid.👉 Solution: A property lawyer conducts thorough due diligence, drafts foolproof agreements, and ensures your rights are protected.Role of a Property Lawyer in Drafting a Sale AgreementTitle Verification – Ensures that the seller has a clear, marketable title to the property.Encumbrance Check – Verifies whether the property is free from loans, mortgages, or litigation.Custom Drafting – Tailors clauses to protect the buyer’s or seller’s interest (payment schedule, penalty clauses, force majeure, etc.).Compliance with Law – Ensures the agreement follows provisions under the Indian Contract Act, 1872, Transfer of Property Act, 1882, and RERA (for under-construction projects).Safeguard Against Defaults – Drafts clear remedies if either party defaults.Role of a Property Lawyer in Drafting & Verifying a Sale DeedDrafting Ownership Transfer Clauses – Ensures that the rights, title, and interest are properly transferred.Stamp Duty & Registration – Calculates exact stamp duty and ensures proper registration under the Registration Act, 1908.Verification of Property Details – Correct description of property (survey no., boundaries, area, municipal records).Witness & Execution Formalities – Ensures that execution is legally valid with witnesses and signatures.Avoiding Future Disputes – Drafts clear indemnity and possession clauses to prevent litigation.Case Laws Highlighting Importance of Proper Sale DeedsSuraj Lamp & Industries Pvt. Ltd. v. State of Haryana (2011) 14 SCC 729The Supreme Court held that property transfer can only be done by a registered sale deed, not by GPA or agreement alone.Hardev Singh v. Gurmail Singh (2007) 2 SCC 404Court clarified that mere possession under an agreement does not give ownership rights; only a registered sale deed can.K.B. Saha & Sons Pvt. Ltd. v. Development Consultant Ltd. (2008) 8 SCC 564Highlighted that vague or incomplete clauses in property documents can cause disputes and litigation.💡 Takeaway: A poorly drafted or unregistered sale deed is a legal risk. Always use a property lawyer.How Property Lawyers Prevent FraudConducting a search in land records office for encumbrances.Checking mutation records and municipal approvals.Verifying RERA registration for under-construction projects.Scrutinizing previous chain of documents to ensure no breaks in ownership.Cross-checking with bank records if property is mortgaged.✨ Don’t risk your hard-earned money. Secure your property deal with KHA Advocates – experts in property law. From drafting to registration, we ensure a safe, transparent, and hassle-free property transaction.Frequently Asked Questions (FAQs)Q1: Can I buy property without a sale agreement?No. A sale agreement is essential to record terms before executing the final sale deed.Q2: Is notarization enough instead of registration?No. Only a registered sale deed under the Registration Act, 1908, gives you legal ownership.Q3: Can I draft my own sale deed?Technically yes, but it is risky. Property law is complex. Errors can lead to disputes or even cancellation of the sale.Q4: How much does a property lawyer charge for sale deed drafting?Charges vary depending on complexity, location, and property value. At KHA Advocates, we provide cost-effective, transparent legal services.Q5: What if the seller refuses to execute the sale deed after agreement?You can file a Suit for Specific Performance under the Specific Relief Act, 1963. A lawyer will represent you in court.Contact KHA Advocates — Your Property Law Partner📍 Office: KHA Advocates – Property & Real Estate Legal Services📞 Phone : (+91) 94-777-5-888-5📞 WhatsApp: (+91) 8101-555-666📧 Email: contact@khaadvocates.in🌐 Website: www.khaadvocates.com🔗 Quick Appointment Link: https://khaadvocates.com/book-consultation👉 Call us today to book a consultation with our expert property lawyers before signing your sale agreement or sale deed.

Read More

🔹 IntroductionBuying property in New Town, Kolkata is a dream for many. But property registration is not just paperwork — it’s a legal safeguard that determines whether your investment is truly secure. A single mistake can cost you ownership rights, money, and years in court battles.👉 This is why you need a Property Registration Lawyer — to make sure your purchase is legally valid, dispute-free, and future-proof.🔹 What is Property Registration?📖 Under the Registration Act, 1908, property transactions above ₹100 must be registered.📌 Registration = official proof of ownership.📌 Without registration = property has no legal value.In West Bengal, registration also requires compliance with the Stamp Act & Registration Rules.⚠️ Problems Buyers Face Without a Lawyer🚫 Fake/forged documents from sellers🚫 Property under litigation or mortgage🚫 Wrong calculation of stamp duty → penalties🚫 Poorly drafted Sale Deed favoring seller🚫 Encroachment & ownership disputes👉 Solution: Hire a lawyer for due diligence + drafting + registration.🔹 How a Property Registration Lawyer Helps YouA Property Registration Lawyer provides end-to-end support in:a) Title Verification & Due DiligenceChecking original ownership documents (deed, khatian, mutation, tax receipts).Ensuring the property is free from litigation, mortgage, or encumbrance.Searching records at the Sub-Registrar’s office.b) Drafting & Reviewing the Sale DeedCustomizing clauses to protect the buyer’s rights.Ensuring there is no vague language that may favor the seller.Including indemnity clauses against future disputes.c) Stamp Duty & RegistrationCorrectly calculating stamp duty and fees under West Bengal Stamp Act.Filing the necessary documents with the Sub-Registrar.d) Execution & HandoverEnsuring smooth registration before the registering officer.Obtaining the certified copy of the registered deed.Advising on mutation and municipal tax transfer post-registration.Let's Summarise for you ✅ Title Verification – checks deeds, khatian, mutation, encumbrances✅ Drafting Sale Deed – buyer-friendly clauses, indemnity terms✅ Stamp Duty & Fees – accurate calculation under WB law✅ Registration Process – smooth execution at Sub-Registrar’s office✅ Post-registration – mutation, tax transfer, possession⚖️ Case Laws You Must KnowSuraj Lamp & Industries v. State of Haryana (2011) – Only a registered deed transfers ownership.K.B. Saha & Sons v. Development Consultant Ltd. (2008) – Unregistered documents = no legal proof of ownership.👉 Moral: Without proper legal registration, you don’t own the property.🏙️ Why Special Care in New Town, Kolkata?Most properties in New Town are leasehold under HIDCO.⚠️ Risks:Government permission needed for transferLease restrictions applyWrong drafting = cancellation of allotment👉 Only a lawyer experienced in HIDCO leasehold rules can protect you.✅ How We Help at KHA Advocates🔹 Title search + due diligence🔹 Custom deed drafting🔹 Registration at Sub-Registrar’s office🔹 NRI buyer assistance via Power of Attorney🔹 Post-registration services (mutation, tax, possession)💡 We make property registration 100% safe, legal, and stress-free.❓ FAQsQ1: Is a lawyer mandatory for property registration?➡ No, but without one, you risk fraud & defective deeds.Q2: Can NRIs register without visiting India?➡ Yes, via Power of Attorney.Q3: How long does registration take?➡ 2–4 weeks depending on clearances.📞 Contact Us TodayDon’t risk your dream home or investment. Protect it with expert legal help.📲 Call: (+91) 94-777-5-888-5📲 WhatsApp: (+91) 8101-555-666📧 Email: contact@khaadvocates.in🌐 Website: www.khaadvocates.com🔗 Book Appointment: https://khaadvocates.com/book-consultationProperty registration is the foundation of ownership. In places like New Town, Kolkata, where leasehold rules make transactions tricky, hiring a Property Registration Lawyer ensures your investment is safe, legal, and hassle-free.👉 Choose smart. Choose legal security. Choose KHA Advocates.

Read More

IntroductionBuying your dream home is one of the biggest financial and emotional decisions of life. Many buyers, especially first-time buyers, are drawn towards under-construction flats or apartments because they are often cheaper than ready-to-move-in properties and come with flexible payment options. However, under-construction properties also involve higher risks, such as project delays, legal disputes, or even fraud.As a buyer, knowing the legal process, safety measures, and essential do’s & don’ts can help you secure your investment and avoid unnecessary stress.At KHA Advocates, we assist property buyers with end-to-end legal support, from due diligence to registration, ensuring you buy your home with complete confidence.Step-by-Step Legal Process of Buying an Under-Construction Flat1. Check RERA RegistrationVisit your state’s RERA (Real Estate Regulatory Authority) portal.Verify whether the project is registered.Check the builder’s past projects, timelines, and compliance status.👉 Why it matters: Only RERA-approved projects provide legal safeguards for buyers.2. Verify Builder’s Title & ApprovalsConfirm the builder has clear ownership or development rights over the land.Check approvals from local authorities (municipality, fire, environmental clearance, etc.).👉 Why it matters: Buying from a builder without proper approvals can lead to cancellation of the project.3. Examine the Builder-Buyer AgreementCarefully review clauses on possession date, construction linked payments, cancellation, and refund policies.Look for hidden charges (maintenance, parking, club membership, etc.).👉 Why it matters: This agreement defines your rights – a lawyer can help negotiate unfavorable terms.4. Payment & Home Loan ProcedurePayments should follow the construction-linked plan and not exceed 10% before agreement registration (as per RERA).For home loans, banks conduct their due diligence – but don’t rely solely on bank approvals.5. Registration of Agreement for SaleLegally register your agreement at the Sub-Registrar’s office.Pay applicable stamp duty & registration charges.6. Possession & Occupancy CertificateBefore possession, check for Occupancy Certificate (OC) and Completion Certificate (CC).Without these, the property is legally incomplete.Safety Measures Before Booking an Under-Construction Flat✅ Check Builder’s Reputation – Past delays, litigation, financial standing.✅ Verify Carpet Area – RERA mandates selling on carpet area, not super built-up.✅ Escrow Account Compliance – Ensure builder deposits 70% of buyer’s funds in RERA account.✅ Timely Updates – RERA requires builders to provide construction progress updates online.✅ Legal Scrutiny of All Documents – Hire a property lawyer to verify every paper.Do’s & Don’ts List for Buyers✅ Do’s:Do verify the project’s RERA registration.Do conduct a legal title check of the land.Do hire a real estate lawyer for document vetting.Do keep all receipts, agreements, and builder communication in writing.Do check for hidden charges like GST, maintenance, parking.❌ Don’ts:Don’t rely solely on the builder’s brochure or promises.Don’t pay more than 10% of the cost before agreement registration.Don’t skip checking OC & CC before taking possession.Don’t ignore the fine print in the builder-buyer agreement.Don’t book based only on verbal assurances or flashy advertisements.Case Study: Buyers Saved by Legal Due DiligenceA group of buyers in Kolkata booked flats in an under-construction project that was heavily advertised. Our team at KHA Advocates was approached for due diligence. Upon inspection, we found that:The land title had a pending litigation.The builder had failed to secure environmental clearance.By acting early, the buyers avoided investing in a risky project and redirected their funds into a RERA-compliant development.👉 Lesson: A small investment in legal checks can save you from losing your life savings.Why You Need a Real Estate Lawyer for Under-Construction PropertiesContract Protection – Lawyers help negotiate builder-buyer agreements to protect your interests.Fraud Prevention – Prevents scams by verifying builder credentials and land titles.Compliance Checks – Ensures approvals and sanctions are in place.Dispute Resolution – Quick legal recourse in case of delays or defaults.Peace of Mind – Focus on your dream home while your lawyer safeguards your investment.ConclusionBuying an under-construction flat can be rewarding, but it comes with risks that only expert legal guidance can minimize. Don’t let hidden clauses, delayed possession, or fraud turn your dream home into a nightmare.At KHA Advocates, we specialize in property law and real estate legal services. From document verification to dispute resolution, we ensure that your home-buying journey is secure, transparent, and stress-free.👉 Build your dream home with confidence – Partner with KHA Advocates today!📞 Contact Us: +91-9477758885📧 Email: contact@khaadvocates.in📍 Location: New Town, Near CC2, Kolkata, West Bengal, India🌐 Visit: www.khaadvocates.com

Read More

IntroductionThe real estate industry is one of the most lucrative yet legally complex sectors in India. Every deal—whether it’s the purchase of land, the sale of flats, or large-scale township development—comes with a web of contracts, regulatory approvals, and compliance obligations. For real estate agents and developers, success is not just about finding the right buyer or executing a project; it’s about ensuring that every step is legally secure.This is why having an expert real estate lawyer on your side is no longer optional—it is a necessity. At KHA Advocates, we specialize in providing end-to-end legal solutions to real estate agents, developers, and investors, ensuring smooth transactions, risk mitigation, and faster deal closures.Why Real Estate Lawyers Are Indispensable1. Property Title Verification & Due DiligenceBefore finalizing any property deal, it is crucial to verify ownership and legal status.Our lawyers conduct title searches, encumbrance checks, mutation record verification, and litigation status checks.This ensures that developers and agents never risk selling or promoting disputed properties.2. Drafting & Reviewing AgreementsReal estate transactions involve Agreements to Sell, Sale Deeds, Development Agreements, Lease Deeds, RERA-compliant builder-buyer agreements, and Joint Venture Contracts.A minor error in drafting can lead to years of litigation or financial loss.Our expert lawyers ensure every clause safeguards your interest, prevents disputes, and complies with Indian property law.3. RERA Compliance & Regulatory ApprovalsWith the introduction of RERA (Real Estate Regulatory Authority), developers must comply with stringent guidelines before advertising or selling projects.We assist in RERA registration, quarterly compliance, buyer dispute defense, and regulatory filings.Real estate agents and developers who work with us avoid penalties, project delays, and reputational risks.4. Dispute Resolution & Litigation SupportProperty disputes are common—ranging from delayed possession claims, land acquisition disputes, buyer complaints, or contractual disagreements.Our legal team represents clients before RERA, Consumer Courts, Civil Courts, High Courts, and Arbitration Tribunals.Having a strong legal partner ensures disputes are handled strategically and quickly, protecting your brand reputation.5. Taxation & Financial StructuringReal estate transactions are heavily taxed through stamp duty, GST, TDS, and capital gains tax.Our lawyers collaborate with tax experts to structure deals in the most tax-efficient way, ensuring compliance while maximizing profits.6. Joint Ventures & Builder CollaborationsMany developers enter into Joint Development Agreements (JDAs) with landowners.Without proper legal safeguards, developers risk losing control or profits.Our team ensures fair drafting, profit-sharing clarity, exit clauses, and dispute resolution mechanisms in such collaborations.7. Faster Deal Closures with Legal BackupA property deal backed by a reputed law firm builds trust among buyers, investors, and financial institutions.When buyers see that all documents are vetted by KHA Advocates, confidence increases, leading to quicker sales and project funding.Why Real Estate Agents & Developers Prefer KHA Advocates✅ End-to-End Support – From due diligence to litigation defense.✅ RERA Specialists – Complete compliance support.✅ Deal Structuring Experts – Tax-efficient, legally sound transactions.✅ Strong Dispute Defense – Representation across courts and tribunals.✅ Trusted by Investors & Homebuyers – Our legal certification enhances credibility.Example Case StudyA leading developer in Kolkata faced a buyer dispute over delayed possession. The case went to RERA, where the buyer demanded refund with interest. By strategically defending the matter, KHA Advocates helped the developer avoid a ₹2 crore liability and negotiated an amicable settlement, saving both reputation and money.ConclusionIn today’s competitive real estate market, having an expert real estate lawyer is not a luxury—it’s a business strategy. From compliance to dispute resolution, lawyers ensure that every deal is legally sound, every agreement is enforceable, and every project runs without costly interruptions.At KHA Advocates, we pride ourselves on being the legal backbone for real estate agents and developers, empowering them to focus on growth while we safeguard their legal interests.Let's Connect with an Expert👉 Are you a real estate agent or developer looking for a trusted legal partner?👉 Do you want hassle-free deal closures, RERA compliance, and dispute protection?📞 Contact KHA Advocates today and let our expert real estate lawyers secure your deals.

Read More

IntroductionThe Enemy Property Act, 1968 has often been in the news due to high-profile property disputes. One of the most talked-about cases involves Bollywood actor Saif Ali Khan and the prestigious Pataudi Estate. While many see this as a family inheritance matter, legally it is much more complicated, as the Enemy Property Act directly governs whether heirs like Saif can claim ownership of certain ancestral assets.This blog explores the legal perspective on the Enemy Property Act, its relevance to the Pataudi Estate dispute, and how it impacted Saif Ali Khan’s inheritance rights.What is the Enemy Property Act?The Enemy Property Act, 1968 was enacted by the Government of India after the Indo-Pak wars of 1965 and 1971. It essentially deals with properties left behind in India by people who migrated to Pakistan or China during these wars.Such properties were taken over by the Custodian of Enemy Property for India.Heirs of those who migrated were barred from claiming ownership rights.Even Indian citizens related to the “enemy” were restricted from succession to such properties.The law was strengthened further in 2017 through an amendment, making it clear that no heir of an enemy can inherit such property, even if they are Indian citizens.The Pataudi Estate Dispute – BackgroundThe Pataudi family, a prominent royal household in Haryana, traces its lineage back to Nawab Iftikhar Ali Khan and later Nawab Mansoor Ali Khan Pataudi. The estate included prime landholdings, palaces, and ancestral properties.The controversy began when it was argued that certain portions of the Pataudi Estate fell within the ambit of the Enemy Property Act due to the migration of some family members to Pakistan.This created legal hurdles in the inheritance of Saif Ali Khan, son of Mansoor Ali Khan Pataudi and Sharmila Tagore, despite him being an Indian citizen and legal heir.How the Enemy Property Act Affected the Pataudi Estate The legal complications arose because: • Some of Saif Ali Khan’s relatives, including family members connected to Bhopal and Hyderabad princely states, had migrated to Pakistan. • Under the Enemy Property Act, properties belonging to those relatives were considered enemy property. • This meant that even Indian-born heirs like Saif Ali Khan could not automatically inherit certain ancestral properties. Thus, while Saif was declared the legal heir to parts of the Pataudi Estate, the Enemy Property Act restricted his rights over portions of the ancestral property. How Did This Affect Saif Ali Khan? The direct impact of the Enemy Property Act on Saif Ali Khan was significant: 1. Inheritance Restriction – Saif could not freely inherit all properties linked to his ancestors because the law prohibited transfer of enemy property to heirs. 2. Legal Disputes & Delays – The Pataudi family faced litigation and government intervention, leading to a prolonged battle to establish ownership rights. 3. Loss of Royal Assets – Despite being the legal heir, Saif’s rights over parts of the estate were curtailed, preventing him from exercising full control. 4. Symbolic Loss of Heritage – For Saif, the dispute was not only about property value but also about ancestral pride and royal legacy. This demonstrates how even celebrity heirs are not immune to the far-reaching consequences of the Enemy Property ActLegal Perspective on the CaseFrom a legal standpoint, the dispute highlights several critical issues:Conflict between Succession Laws & Enemy Property ActNormally, under the Hindu Succession Act or personal laws, a son inherits his father’s property.However, the Enemy Property Act overrides succession rights, making heirs powerless if the property is classified as enemy property.Doctrine of Public PolicyThe Act is based on national interest, preventing properties linked to “enemies” from being exploited.But, in practice, it often impacts Indian citizens like Saif Ali Khan, raising concerns of fairness.Judicial InterpretationsIndian courts have consistently upheld the supremacy of the Act, limiting the scope of inheritance claims.This shows how special laws override general inheritance provisions.Lessons for Property Owners and HeirsThe Pataudi Estate dispute serves as a cautionary tale for families dealing with ancestral properties. Key lessons include:Title Verification is Crucial – Before claiming or buying any property, ensure it is not under the Enemy Property Act or other restrictions.Legal Documentation Matters – Proper succession deeds, wills, and title clearances can reduce future disputes.Seek Legal Expertise Early – Corporate lawyers and property law experts can prevent disputes from escalating into decades-long battles.NRI Families Must Be Extra Careful – Many NRIs unknowingly inherit properties linked to enemy properties, exposing them to long litigation.How Our Law Firm Can HelpAt KHA Advocates, we specialize in:Property Title Verification – Ensuring properties are free from legal encumbrances before purchase or transfer.Inheritance & Succession Advisory – Drafting wills, succession certificates, and family settlements to secure property rights.Dispute Resolution & Litigation Support – Representing clients in property disputes, including those under special laws like the Enemy Property Act.NRI Property Services – Helping NRIs manage, protect, and transfer their properties in India.If you’re facing property disputes or inheritance complications, our expert property lawyers can safeguard your rights.ConclusionThe Enemy Property Act was designed to protect national interests but has had profound implications on individual inheritance rights. The Saif Ali Khan Pataudi Estate dispute is a high-profile example of how this law can prevent rightful heirs from accessing ancestral property.For business owners, heirs, and NRIs, the key takeaway is clear: always seek legal due diligence and expert advice before claiming, buying, or transferring property👉 If you need guidance on property disputes, connect with KHA Advocates today and protect your rights before it’s too late.

Read More

Buying land in West Bengal can be rewarding—but only if you get the legal basics right. This guide walks you through due-diligence steps, must-know rules under Bengal laws, and the current stamp duty & registration charges, with quick examples, case-law checkpoints, and a simple checklist you can use before you sign.1) Start with a Clean Title: What to Verifya) Chain of Title (minimum 30 years).Collect all prior deeds (sale, gift, partition, exchange) and compare RS/LR Dag & Khatian numbers, Mouza, and area across documents.Ensure there are no gaps in the chain and that every transferor actually had the right to sell.b) Encumbrance Check.Obtain an Encumbrance Certificate and search the Sub-Registrar’s records for mortgages, lis pendens, attachments, court orders, or ongoing disputes.c) Mutation vs. Ownership.Mutation (name change in Record-of-Rights/Porcha) is important for tax and utilities but it doesn’t prove ownership. Courts repeatedly hold that mutation entries are only for fiscal purposes and don’t create or extinguish title. d) Land Use & Conversion (Agricultural to Non-Agricultural).For agricultural plots, check conversion permissions (where applicable) and land-use restrictions before development.Verify local plans, zoning, road-widening reservations, waterbodies, thika land issues, coastal or forest restrictions, etc.e) Possession & Boundaries.Conduct a site survey with a licensed surveyor; match ground boundaries with revenue maps and deeds.Confirm access/right of way is legal and undisputed.f) Special Estates & Leaseholds.In areas like Bidhannagar (Salt Lake) and some industrial estates, you’re often buying leasehold rights with transfer conditions and authority permissions. Review allotment letters, lease deeds, and transfer policies carefully.Case-law guardrail: The Supreme Court in Suraj Lamp & Industries v. State of Haryana (2011) held that GPA/Agreement-to-Sell/Will (“SA/GPA/Will”) transactions do not convey title; only a registered conveyance deed transfers ownership of immovable property. Don’t rely on “GPA sales.” 2) Agreements & Documents You’ll Typically NeedTitle Verification Report (by your lawyer, post record and site checks)Agreement for Sale (with detailed reps/warranties; attach a schedule and accurate site plan)No-objection certificates/permissions (as applicable—ULC/ceiling compliance history, conversion NOC, municipal/revenue clearances, society/lessor consent)Registered Sale Deed at the jurisdictional Sub-Registrar office (mandatory to pass title). Recent Supreme Court guidance re-affirms that documents requiring registration are inadmissible to convey title if unregistered. 3) Stamp Duty & Registration Charges in West Bengal (2025)Use Stamp Duty Calculator developed by KhA AdvocatesImportant policy updates:West Bengal withdrew the temporary 2% stamp duty rebate and 10% circle-rate reduction from July 1, 2024 (initially introduced in Oct 2021). Always budget at full rates now. From January 17, 2024, the State announced stamp duty assessment on carpet area, not super built-up area (and simultaneously revised circle rates). Expect operational nuances while authorities refine forms. How to estimate online: Use the MV/SD/RF Calculator on the West Bengal Registration portal (select “Stamp Duty & Registration Fee”). 4) Bengal-Specific Pitfalls (and how to avoid them)Ceiling & Tenancy footprints: Trace historic land ceiling proceedings/regularizations and tenancy (bargadar) claims.Waterbodies/Khaitan descriptors: If the RoR shows doba, pukur, khal etc., special restrictions may apply; converting and filling may be prohibited without permissions.Thika & Khas Mahal land: Extra layers of consent/eligibility can apply—get a targeted legal opinion.Leasehold in planned townships: Check transfer charges, lessor’s prior consent, and lock-in conditions.Set-offs and approach roads: Verify right of way is recorded; don’t assume a neighbor’s path is public.“GPA sale” or “Notary deed” shortcuts: Avoid—no title passes without a registered conveyance. 5) Micro-Checklist Before You Pay Token Money✅ Title search (30 years) with encumbrance & litigation scan✅ RoR/Porcha & mutation status matched to deeds (knowing mutation ≠ title) ✅ Site survey & boundary match (with LR/RS maps)✅ Land use & conversion permissions verified✅ Utility dues & property tax updated; indemnities for past dues✅ No pending acquisition/road widening reservations✅ Drafting of robust Agreement for Sale (clear reps/warranties, indemnities, timelines, default & refund clauses)✅ Final deed: register at proper SRO; pay stamp duty + 1% registration via GRIPS/IGR portals; collect e-challans & final registered copy. 6) Case-Law Corner (What it means for you)Mutation ≠ Ownership. Courts consistently reiterate that mutation is fiscal/administrative and does not confer title—use it to update records and pay taxes, not as proof of ownership. Only a Registered Conveyance Passes Title. The Supreme Court in Suraj Lamp (2011) held SA/GPA/Willpathways do not transfer ownership. Insist on a registered sale deed. Recent Supreme Court orders continue to underscore Sections 17 & 49 of the Registration Act, 1908—unregistered documents that require registration are inadmissible to convey title. 7) FAQsQ1. What are the current stamp duty and registration rates in West Bengal?A. Registration fee is 1%. Stamp duty varies by location and value slab (e.g., rural 3–4%, urban 4–5% generally; Kolkata/Howrah slabs often reflect 6–7% bands). Use the IGR calculator for your exact local body and property value. Q2. Is the 2% stamp duty rebate still available?A. No. It ended June 30, 2024; normal rates apply from July 1, 2024. Q3. Is stamp duty based on carpet area or super built-up?A. The State announced assessment on carpet area (with other adjustments like circle-rate revisions). Expect implementation nuances; always check the latest form and local SRO practice. Q4. Can I buy through GPA/ATS to save time or cost?A. Avoid. No title passes without a registered conveyance. Q5. Do women or senior citizens get a concession in Bengal?A. Unlike some states, no general gender-based concession is provided; check if any time-bound schemes are notified. Use the IGR calculator for the precise figure. 8) How KHA ADVOCATES Helps You Close Safely (and Save Money)Title & Litigation Deep-Dive: We run a 30-year title audit, encumbrance search, and suit/attachment scan so you don’t inherit hidden risks.Structuring & Tax-smart Drafting: From Agreement for Sale to Sale Deed, we build iron-clad clauses(indemnities, default matrix, delayed possession compensation, price-protection) and align TDS, GST (ifany) and stamp duty planning to avoid penalties.Regulatory Navigation: Conversion, lessor/society permissions, RERA alignment, and municipal compliances—done end-to-end.Registration Day Concierge: Slot booking, GRIPS/IGR e-payments, document checks, witness coordination, and smooth execution at the SRO.'After-care: Mutation applications, tax meter shift, and record updates so your ownership reflects everywhere that matters.Free 15-minute Consultation: Planning to buy land in Kolkata, Howrah, Salt Lake, Siliguri, Durgapur or across Bengal? Book a call with KHA ADVOCATES to get a quick duty estimate + red-flag review of the property before you commit.9) Final TakeawaysDon’t rely on mutation as ownership proof; rely on clear title + registered deed. Budget stamp duty + 1% registration at post-rebate rates (effective July 1, 2024). Use the official calculator for exact numbers by local body and value, and get documents vetted before you pay token money. Need a precise stamp duty & fee calculation for your plot—and a same-day document red-flag review?Message KHA ADVOCATES now. One guided call can save you lakhs and months of stress.

Read More

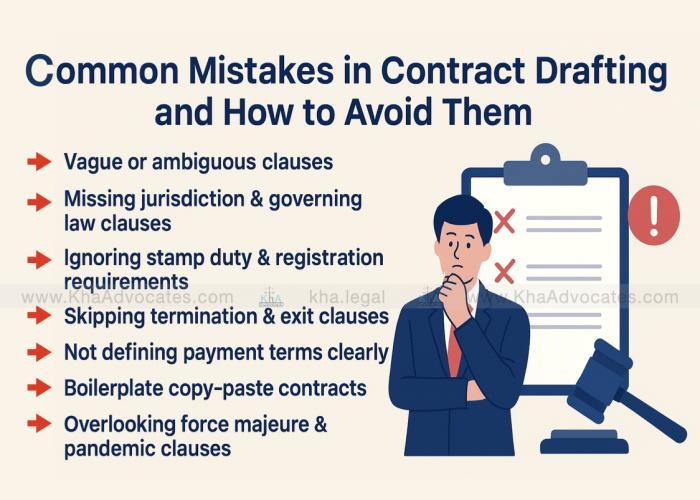

IntroductionContracts are the backbone of every business relationship. Whether you’re a startup signing your first vendor agreement or a corporation negotiating a multi-crore deal, a poorly drafted contract can lead to disputes, losses, and even litigation. In India, contract drafting is governed primarily by the Indian Contract Act, 1872, along with provisions of the Indian Stamp Act, 1899, and relevant judgments by the Supreme Court and High Courts.In this blog, we’ll explore the most common mistakes made during contract drafting, legal consequences, landmark judgments, and practical tips on how to avoid them.1. Vague or Ambiguous ClausesMistake: Using unclear terms such as “reasonable time,” “best efforts,” or “mutual understanding.”Consequence: Leads to multiple interpretations and disputes.Case Law: ONGC v. Saw Pipes Ltd. (2003) – The Supreme Court held that vague clauses can render contracts unenforceable if they lack certainty.Solution: Always use precise, measurable language. For example, instead of “deliver goods on time,” specify “deliver 500 units within 30 days.”2. Missing Jurisdiction & Governing Law ClausesMistake: Failing to specify which court or state laws will govern disputes.Consequence: Parties may file cases in multiple jurisdictions, leading to unnecessary litigation.Case Law: Swastik Gases Pvt. Ltd. v. Indian Oil Corporation Ltd. (2013) – The Supreme Court emphasized the importance of jurisdiction clauses.Solution: Insert a clear clause like: “This Agreement shall be governed by the laws of India, and courts at Kolkata shall have exclusive jurisdiction.”3. Ignoring Stamp Duty & Registration RequirementsMistake: Contracts like leases, partnerships, or property agreements often remain unstamped or unregistered.Consequence: Courts may refuse to admit such documents as evidence.Law: Indian Stamp Act, 1899 and Registration Act, 1908.Example: An unstamped lease deed exceeding 12 months can be declared invalid.Solution: Always calculate proper stamp duty and register agreements wherever required.4. Skipping Termination & Exit ClausesMistake: Not defining conditions for termination or exit of parties.Consequence: Leads to endless disputes when parties want to exit.Case Law: Tata Consultancy Services Ltd. v. Cyrus Investments Pvt. Ltd. (2021) – The importance of clear exit clauses in shareholder agreements was highlighted.Solution: Define termination events (breach, insolvency, force majeure) and lay down notice periods, penalties, and handover procedures.5. Not Defining Payment Terms ClearlyMistake: Contracts state “payment shall be made promptly” without defining mode, due date, or late fee.Consequence: Disputes over payment delays and penalties.Law: Indian Contract Act, 1872 (Section 73 – Compensation for Breach of Contract).Solution: Specify “Payment of ₹10,00,000 shall be made via bank transfer within 15 days of invoice, with 12% interest applicable on delays.”6. Boilerplate Copy-Paste Contracts Mistake: Using internet templates without customization.Consequence: Many clauses may be irrelevant, illegal, or contradictory.Case Study: A startup copied an NDA template online, which did not comply with Indian law. During litigation, the court rejected parts of the NDA.Solution: Always customize contracts based on Indian law, industry, and party requirements.7. Overlooking Force Majeure & Pandemic ClausesMistake: Not including provisions for unforeseen events like pandemics, wars, or natural disasters.Case Law: Halliburton Offshore Services v. Vedanta Ltd. (2020, Delhi HC) – The court recognized COVID-19 as a force majeure event.Solution: Define force majeure events, notification timelines, and consequences (suspension or termination).Practical Tips for Safe Contract DraftingHire a Lawyer: Professional vetting prevents loopholes.Review Twice: Both parties should review drafts carefully.Update Regularly: Revise old contracts to include latest laws and judgments.Use Clear Language: Avoid jargon, keep it simple.FAQs on Contract DraftingQ1. Is an oral contract valid in India?Yes, oral contracts are valid under the Indian Contract Act, 1872, but difficult to prove in court. Always prefer written contracts.Q2. What makes a contract legally enforceable in India?Offer, acceptance, lawful consideration, free consent, lawful object, and capacity of parties.Q3. Can a contract be on plain paper without stamp duty?Yes, it’s valid but may not be admissible in court without proper stamping.Q4. What happens if a contract has a missing clause?Courts may interpret it against the drafter, leading to unfavorable judgments.Q5. How can startups ensure safe contract drafting?By consulting a corporate lawyer to draft customized agreements like Founders’ Agreement, Shareholders’ Agreement, and Employment Contracts.Q6. Do contracts need witnesses?Not always. Only certain agreements like property deeds, wills, or surety bonds need attestation.Q7. Can e-contracts and digital signatures be used in India?Yes, under the Information Technology Act, 2000, e-signatures and e-contracts are legally valid.At KHA Advocates, we specialize in contract drafting, vetting, and negotiation for startups, corporates, and individuals. Our expert lawyers ensure your agreements are legally enforceable, customized to your needs, and dispute-proof.👉 Avoid costly litigation – Book a consultation with KHA Advocates today!

Read More

Introduction: Why RERA Matters for New AgentsIf you’re a real estate agent with less than three years of experience, you’ve probably heard the term RERA thrown around in conversations, training programs, and even client meetings. The Real Estate (Regulation and Development) Act, 2016 was introduced to bring transparency, accountability, and fairness to India’s real estate sector.For agents, RERA is not just a legal formality—it’s your license to operate, build trust, and close deals confidently. In fact, RERA compliance can be your biggest selling point when winning over clients.This guide will walk you through everything you need to know about RERA compliance, with practical tips, legal insights, and real-world advice tailored for agents like you.What is RERA and Why Should Agents Care?RERA was enacted to protect homebuyers and regulate the real estate industry. For agents, it:Makes registration mandatory to operate legally.Requires disclosure of property details before selling.Ensures ethical dealing with both buyers and developers.Failing to comply can result in hefty penalties or even being barred from business. On the flip side, RERA compliance can boost your credibility and help you close more sales.Step-by-Step RERA Compliance Checklist for Agents1. Register Yourself as a RERA AgentWhy? It’s the law. You cannot facilitate property sales without RERA registration.How? Visit your state’s RERA website, fill out the application form, upload required documents, and pay the registration fee.Tip: Always keep your registration number handy—it builds instant trust with clients.2. Understand Your State’s RERA RulesEach state has its own RERA authority and rules. For example, WBRERA in West Bengal, etc.Action Step: Bookmark your state’s RERA website and check for rule updates regularly.Benefit: Staying updated means you won’t accidentally violate new regulations.3. Work Only with Registered ProjectsSelling an unregistered project is a major violation. Always check the RERA project registration number before marketing or selling.Tip: Use the RERA portal to verify project details—buyers love agents who show them official proof.4. Disclose Accurate Information to ClientsUnder RERA, you must share all relevant details about a property—pricing, possession timelines, approvals, and amenities.Best Practice: Maintain a property fact sheet for every listing.5. Maintain Transaction RecordsRERA requires agents to keep proper records of transactions.Why? These can protect you in case of disputes.Pro Tip: Digitize your paperwork using cloud storage—it’s safer and faster to retrieve.6. Avoid Misleading AdvertisementsRule: Do not advertise unapproved layouts, amenities, or false possession dates.Example: If possession is 2027, don’t write “Ready in 2 Years” unless confirmed.7. Renew Your RERA Registration on TimeRERA registrations have an expiry date—usually 5 years, but it varies by state.Tip: Set calendar reminders for renewal at least 3 months in advance.8. Act as a Neutral FacilitatorRERA recognizes agents as intermediaries, not salespeople for one party.Ethics Tip: Always ensure fairness between the buyer and seller.9. Stay Updated with RERA AmendmentsThe law is evolving. Attend RERA workshops, webinars, or legal training to keep learning.Benefit: Your knowledge will set you apart from other new agents.10. Partner with a Legal MentorIf you’re new, navigating compliance can be overwhelming. Working with a law firm specializing in RERA can save you from costly mistakes and even speed up your deal closures.Common RERA Mistakes New Agents MakeSkipping registration to avoid fees.Not verifying projects before selling.Making verbal promises that can’t be kept.Ignoring renewal dates for registration.Not keeping proper documentation of transactions.Avoiding these mistakes will keep your record clean and your reputation strong.How RERA Compliance Helps You Win More ClientsBuilds trust – Buyers feel safer dealing with registered agents.Differentiates you – Many agents still operate without full compliance.Protects you legally – Compliance shields you from penalties and lawsuits.Boosts referrals – Happy, protected clients recommend you to others.FAQ – RERA for New Real Estate AgentsQ1. Do I need RERA registration if I only deal in rentals?A: No, RERA applies to property sales, not rentals. But check your state’s rules for exceptions.Q2. How much does RERA registration cost?A: Fees vary by state—usually between ₹25,000 for individuals.Q3. Can I operate in multiple states with one RERA license?A: No, you need separate registration for each state.Q4. What happens if I sell an unregistered project?A: You can face heavy fines or even imprisonment. Always verify before selling.Q5. How long does RERA registration take?A: Usually 15–30 days, depending on state processing times.Final Thoughts – Your Compliance is Your StrengthAs a new agent, it’s tempting to focus only on closing deals quickly, but in today’s regulated market, compliance is your competitive edge. Buyers and developers want to work with agents they can trust—and RERA compliance is proof of your professionalism.Don’t see RERA as a hurdle; see it as a business tool that helps you stand out in a crowded market.Let’s Build Your RERA-Ready CareerAt KHA Advocates, we act as your legal mentor—guiding you through RERA registration, project verification, agreement vetting, and compliance training.Whether you’re a new broker or a growing agency, our legal support ensures you operate 100% within the law while building a trustworthy brand.📞 Call us today at 9832-555-666 or 📧 email us at contact@khaadvocates.in to start your RERA-compliant journey.

Read More

Booking a flat—especially in an under-construction or newly launched project—is a big step for any property buyer or investor. While glossy brochures, virtual tours, and builder promises may look appealing, failing to conduct a legal due diligence check before booking can result in financial losses, stalled projects, or court battles.At KHA ADVOCATES, we help buyers—especially first-timers and NRIs—safeguard their investments with comprehensive legal support. This guide lays out a legal checklist to follow before you pay that booking amount.1. Check if the Builder is RERA RegisteredWhy it matters:Under the Real Estate (Regulation and Development) Act, 2016, all builders must register their residential projects (above a certain size) with RERA.What to verify:RERA Registration NumberProject details on your state’s RERA websiteCompletion timeline and approvalsTip: Visit https://rera.gov.in and cross-check project details.📌 KHA Tip: We verify RERA registration and flag any discrepancies before you invest.2. Verify Title of the LandWhy it matters:The builder must legally own or have development rights over the land. If the land title is disputed or not clear, the entire project becomes risky.What to verify:Title Deed and Ownership Chain (30-year verification)Encumbrance Certificate (EC)Lease/Development Agreements (if applicable)📌 KHA Tip: We conduct deep title verification and provide certified legal title reports.3. Check Project Approvals & SanctionsWhy it matters:Without proper municipal and environmental approvals, the builder may face demolition or delay orders. You risk losing time and money.Key approvals to verify:Commencement Certificate (CC)Building Plan Sanction by local authorityEnvironmental Clearance (for large projects)Fire Safety and Airport NOC (if applicable)📌 KHA Tip: We inspect all sanctions and compare them with construction on-ground.4. Examine the Allotment Letter & Builder-Buyer AgreementWhy it matters:These are legally binding documents that define your rights, timelines, penalties, and possession terms.Watch for:Clause on delivery date and delay penaltiesForce majeure clausesEscalation charges or hidden costsRefund/termination terms📌 KHA Tip: We negotiate the Builder-Buyer Agreement and protect you from one-sided terms.5. Understand the Carpet Area ClausesWhy it matters:Builders often quote “super built-up area” to appear cheaper. But you only own the carpet area.Legal point:RERA mandates disclosure of carpet area and its definition.What to check:Clearly mentioned carpet areaLoading % (difference between super built-up and carpet)Agreement mentions area escalation clauses?📌 KHA Tip: We break down the loading percentage and explain your actual usable space.6. Check for Litigations & Pending CasesWhy it matters:Even a high-profile project can have pending disputes or litigation that stalls completion.How to check:Builder’s litigation history (via High Court/SC portals)RERA complaintsConsumer forum or NCLT disputes📌 KHA Tip: We do background checks on builders across legal portals and flag red zones.7. Verify the Builder’s Previous ProjectsWhy it matters:Past delivery record speaks volumes about future reliability.Things to verify:Completion historyQuality of constructionDelay frequencyConsumer complaints📌 KHA Tip: We verify past project delivery and check for blacklisted builders.8. Check Home Loan Pre-Approvals (If Any)Why it matters:If reputed banks have approved loans for the project, it signals that due diligence has been done. Still, it’s not foolproof.Check for:Which banks have approved the projectLoan eligibility termsLoan-to-value ratio offered📌 KHA Tip: We independently verify bank clearance and help you secure home loans at best rates.9. Ensure GST, Stamp Duty, and Tax Implications Are ClearWhy it matters:Tax liabilities, if not properly calculated, can spike your cost by lakhs.What to check:GST applicable for under-construction flats (usually 5% without ITC)Stamp duty & registration chargesTDS (1%) if value exceeds ₹50 lakh📌 KHA Tip: We help optimize your property taxes and legally reduce stamp duty wherever possible.10. Review Possession Timeline & Completion CertificateWhy it matters:You must legally take possession only after receiving the Occupancy Certificate (OC) or Completion Certificate (CC).Ensure:Delivery date is not vagueCompensation clause for delayFinal handover includes OC and NOC from authorities📌 KHA Tip: We ensure legal handover, post-registration compliance, and verify builder’s obligations.🚨 Never Pay in Cash or Unaccounted PaymentsWhy it matters:Any cash transaction is illegal and non-defendable in court. Always insist on full transparency.📌 KHA Tip: We ensure all payments are through legal channels and documented properly.Why Buyers & Investors Choose KHA ADVOCATESAt KHA ADVOCATES, we don’t just “check papers”—we secure your entire property purchase from booking to registration. Whether you’re a first-time buyer or seasoned investor, our services include:✔️ Title Verification (30 years)✔️ Builder-Buyer Agreement Drafting & Review✔️ Property Registration & Mutation✔️ Stamp Duty Optimization✔️ Legal Due Diligence & Litigation Check✔️ Home Loan Legal Support✔️ Dispute Prevention & Litigation📞 Ready to Book a Flat? Don’t Do It Without Legal Backing.📞 Book a Legal Consultation with KHA ADVOCATES👉 Call us now : 94-777-5-888-5👉 WhatsApp: 8101-555-666👉 Email us: contact@khaadvocates.in👉 Visit: www.khaadvocates.com

Read More

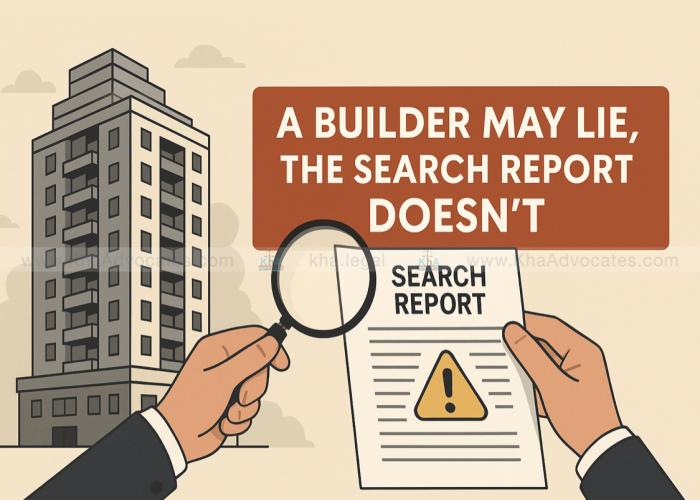

IntroductionBuying a property—especially for NRIs or first-time buyers in West Bengal—is often seen as a milestone achievement. However, what’s not visible in glossy brochures and site visits are the hidden charges that can inflate your cost by lakhs. Whether you’re eyeing a premium flat in Salt Lake or an investment property in Durgapur, knowing what lies beneath the surface is crucial to avoid legal and financial pitfalls.At KHA ADVOCATES, we’ve helped hundreds of clients legally uncover and prevent hidden property costs through rigorous legal due diligence, title search, and registration support.⚠️ Common Hidden Charges Most Buyers Overlook1. Legal Scrutiny & Title Due Diligence (Or Lack Thereof)Builders often charge legal processing fees, but these do not include independent title verification. Many NRIs assume the property is “clear,” only to later face disputes.Real Case: A buyer in New Town discovered, post-payment, that the property was under litigation despite having paid legal fees to the builder.✔️ Solution: Always appoint your own property lawyer for due diligence.2. GST on Under-Construction PropertyAs per current law, under-construction properties attract 5% GST (without ITC), while ready-to-move flats are exempt if the completion certificate is received.💡 Tip: Ask for the CC or OC (Occupancy Certificate) to avoid unnecessary tax burdens.3. Car Parking ChargesParking isn’t “free.” Many builders in Kolkata and Salt Lake charge ₹2–6 lakhs for open or covered parking, despite Supreme Court rulings stating parking cannot be sold separately from the flat.📜 Case Reference: Nahalchand Laloochand Pvt Ltd v. Panchali Co-op Housing Society Ltd – SC held that open parking cannot be sold as an independent unit.4. Clubhouse & Maintenance DepositsThese are often presented vaguely as “amenities charges.” In gated communities, builders demand 1–3 years of advance maintenance and non-refundable clubhouse development fees.✔️ Ask for a breakup of maintenance charges and get it in writing.5. Advance Registration ChargesSome developers insist on upfront registration payments. But beware—many delay handing over sale deeds or register in builder’s name first, forcing resale to buyer with double registration fee.✔️ Registration should only happen after OC/CC and full payment clearance.6. Hidden Floor Rise ChargesEven within the same building, rates differ per floor. Builders in Durgapur, Salt Lake, and Alipore may add ₹20–₹100/sqft for “floor rise” without disclosing this early.7. PLC – Preferential Location ChargesCorner flats, park-facing units, or east-facing homes may have added costs. These are negotiable but often hidden until agreement.✔️ Ask early about PLCs. Always include a clause to limit variation in final price.8. Delayed Possession Penalties SkippedAgreements often don’t mention compensation if possession is delayed. Or worse, they include one-sided clauses favoring the builder.📜 RERA mandates a fixed timeline and penalty for delay under West Bengal Housing Industry Regulation Act (WBHIRA).Legal Checklist to Avoid Hidden Charges✅ StepWhat You Must Check🔍 Title VerificationIndependent search of 30+ years of ownership📜 Agreement ClausesClear breakup of GST, PLC, parking, and maintenance🏗️ RERA RegistrationEnsure property is registered on WBHIRA portal🧾 All-Inclusive QuotationAvoid “base price” traps—ask for final cost🖋️ Builder-Buyer AgreementLegally vetted, RERA-compliant contract🧑⚖️ Legal OpinionHire a property lawyer—not builder’s panel advocatePros and Cons: Ready-to-Move vs Under-Construction in West BengalFeatureReady-to-MoveUnder-ConstructionGST✅ No GST❌ 5% GST (no ITC)Hidden ChargesFewerMany (Amenities, Floor rise, PLC)Risk of DelayMinimalHigh without strong contractRegistration TimelineImmediatePost-completionLegal SecurityHighMedium (depends on due diligence)Real-Life Case Study – How Legal Help Saved a Homebuyer ₹5.5 LakhsA client from Baharampur booked a flat in Chinsurah and was asked to pay ₹3 lakhs as “advance clubhouse charges” and ₹2.5 lakhs for “parking rights.” Our legal team reviewed the documents and found both charges illegal under WBHIRA and Supreme Court guidelines. After a formal notice, the builder dropped all additional demands.✔️ Result: Buyer saved ₹5.5 lakhs and got clean registration within 30 days.Frequently Asked Questions (FAQs)Q1: Can I refuse to pay parking charges to a builder?Yes, especially if it’s for open parking. Covered parking may be charged nominally but must be included in the sale agreement.Q2: Are these hidden charges legal under RERA/WBHIRA?No. Builders are mandated to disclose all charges up front. Any deviation can be challenged before the WBHIRA authority.Q3: What if the builder delays possession after I’ve paid full amount?Under RERA, you’re entitled to interest compensation or withdrawal with refund. Get a lawyer to enforce this through legal notice or complaint.Why Choose KHA ADVOCATES?Whether you are an NRI, first-time buyer, or investor, our legal team offers:✅ Title Verification & Search Report (30+ Years)✅ Sale Agreement & Deed Drafting✅ Builder-Buyer Agreement Vetting✅ Registration Support across West Bengal✅ RERA Dispute Handling & Legal NoticesWe’ve helped over 100 clients across New Town, Kolkata, Hooghly, Siliguri, and Durgapur avoid hidden traps and legally secure their investment.ConclusionHidden charges aren’t just financial nuisances—they can become legal nightmares. If you’re buying a property in New Town, Salt Lake, Baharampur, or anywhere in West Bengal, make sure your investment is protected with the right legal guidance.Ready to Buy Property in West Bengal?📞 Book a Legal Consultation with KHA ADVOCATES👉 Call us now : 94-777-5-888-5👉 WhatsApp: 8101-555-666👉 Email us: contact@khaadvocates.in👉 Visit: www.khaadvocates.com

Read More

The Real Estate (Regulation and Development) Act, 2016 (RERA) is now the bedrock of homebuyer protection in India. Under RERA, developers must register each project and deposit most buyer funds in an escrow account (at least 70%) for that project . The latest 2024–25 guidelines strengthen this further. For example, MahaRERA’s Order 57/2024 now requires every sale agreement to list all promised amenities (gym, pool, garden, etc.) and their handover dates . This ensures developers clearly communicate project features and timelines to buyers.RERA also enforces tough penalties for delays or defaults. Section 18 of the RERA Act gives buyers the right to exit a project and get a full refund (with interest) if the builder misses possession deadlines . This isn’t just theory: in early 2025, a Karnataka RERA tribunal ordered a builder to return ₹2.56 crore (with interest) to a flat-buyer after a seven-year delay . Likewise, Haryana’s RERA recently held a developer accountable for a decade-long delay, ordering him to refund ₹1.07 crore plus 11.1% interest (total ₹2.26 crore) to the buyer . Builders must also fix structural defects at their own cost for five years after possession, extending warranty protection far beyond older norms.Because of RERA’s enforcement, buyers now see promised homes and amenities materialize more reliably. Developers must commit to fixed delivery dates for every facility – from swimming pools to clubhouses – or face penalties. For instance, Telangana RERA found a Hyderabad project only 20% complete after three years and ordered refunds with 11% interest to all 62 buyers for the delay . Experts note that requiring exact handover dates “adds accountability,” since homebuyers clearly know when to expect each promised feature .Other key safeguards remain in force. By law, 70% of the money you pay to the builder must go only into the RERA-designated account for that project , preventing diversion of funds. Builders cannot advertise or sell flats before RERA approval, and any violations invite penalties or cancellations. Importantly, recent court rulings confirm that homebuyers can pursue remedies under RERA and under consumer-protection laws simultaneously. In short, fraud or delay can no longer be swept under the rug – homebuyers now have multiple legal venues to insist on fair play.While RERA is implemented state-by-state, its core protections are national. In fact, regulators are building a unified national RERA portal to standardize data across all states . Soon, any buyer will log in and see a developer’s entire track record and project status across India. This integrated system will group every project of a builder together (preventing them from hiding bad history under shell entities) . The goal is to give flat buyers one-click access to key project information and quickly flag any non-compliance.Simplified Checklist for Flat Buyers (2025)Verify RERA registration: Always check that your flat’s project and the developer are registered on the state RERA portal. Official RERA websites list project approvals, layout plans and quarterly progress updates. If the builder isn’t RERA-registered, walk away – you lose all legal protection .Review sale agreement disclosures: Confirm the agreement spells out all promised amenities (pool, gym, garden, etc.) and the deadlines for each . New RERA rules require this level of detail. Any major change later needs the consent of two-thirds of homebuyers . If an amenity is promised in marketing, it must be clearly in the contract.Monitor progress and escrow: Ensure 70% of your payments are going into the RERA escrow account (ask the builder or check RERA filings for confirmation). Track construction progress via the RERA portal or status reports. Soon you’ll even be able to use the national RERA platform to compare projects nationwide . Regularly check that the project is meeting its promised milestones.Know your remedies: If possession is delayed, RERA Section 18 guarantees a full refund plus interest on your payments . If you stay invested, you’re entitled to monthly interest for each month of delay. After handover, RERA gives you a 5-year warranty on structural or major defects. Keep all documents and immediately notify the builder (and RERA) of any delays or defects.Use official grievance channels: File a complaint on the RERA portal at the first sign of trouble. State RERAs generally resolve valid cases within a few months once hearings are scheduled. You can also approach a consumer court in parallel. Provide your sale deed, payment receipts and correspondence to strengthen your case.Engage expert help: RERA compliance can be complex for first-time buyers. Consider consulting RERA verification specialists to review the project before booking. Our RERA compliance service can audit the project’s registration, agreements and builder track record against the latest rules. This expert check helps you avoid costly mistakes.Partner with RERA Compliance ExpertsKeeping up with RERA updates and legal paperwork can be daunting. Our firm offers dedicated RERA compliance guidance to simplify the process. We will review all project documents, verify the builder’s RERA registration and ensure every new 2025 guideline is satisfied. We even monitor construction updates and follow up with regulators if needed. By turning a complex legal checklist into step-by-step guidance, we give you peace of mind. With experts on your side, you can confidently move forward with your new home purchase.Key takeaway: RERA 2025 is about transparency and accountability. Use the above checklist before signing any deal. Remember, under RERA delays and omissions now cost the builder – not you – as confirmed by recent rulings . Armed with the latest guidelines and professional support, flat buyers can invest with confidence.Here’s a promotional and lead generation section tailored for your blog article, “New RERA Guidelines Every Flat Buyer Should Be Aware Of (2025 Edition)”, designed to fit seamlessly near the end of the blog and optimized for SEO and conversion:Why Choose KHA ADVOCATES for RERA Compliance & Property Legal Support?At KHA ADVOCATES, we specialize in protecting the rights of NRI clients, first-time homebuyers, and real estate investors across Kolkata, including New Town and Salt Lake. With decades of experience in real estate law, we ensure that your property journey is legally secure, RERA-compliant, and stress-free.Our RERA & Property Legal Services Include:Full RERA Project Verification (West Bengal RERA, pan-India)Sale Agreement & Builder Agreement VettingTracking Escrow & Possession Timeline CommitmentsLegal Due Diligence & Title Search ReportSupport in Filing RERA Complaints & Refund ClaimsRegistration, Stamp Duty, Mutation & HIRA AssistanceWhether you’re booking a ready-to-move apartment in Salt Lake or investing in an under-construction property in New Town, we’ll help you understand:✔ What your builder can and cannot do under RERA✔ Whether your documents meet 2025 legal compliance✔ What your refund or compensation rights are if timelines slip📞 Book a Free Consultation TodayAvoid costly legal pitfalls before you buy. Let KHA ADVOCATES protect your investment with verified property documentation and expert RERA compliance.👉 Call us now : 94-777-5-888-5👉 WhatsApp: 8101-555-666👉 Email us: contact@khaadvocates.in👉 Visit: www.khaadvocates.com👉 Offices: Kolkata | Virtual Consultations for NRIs 🌐🔐 Buying a Flat? The Builder May Promise. We Legally Verify.Stay protected. Stay informed. Partner with KHA ADVOCATES — your trusted legal shield in Indian real estate.

Read More

IntroductionBuying a flat is a milestone. But a critical question arises for every buyer:Should you go for a ready-to-move-in flat or an under-construction property?While both options come with distinct advantages, the legal implications, risks, and due diligence steps differ drastically. This blog breaks down the legal pros and cons of both choices—especially for first-time home buyers, real estate investors, and NRIs planning to invest in areas like New Town, Salt Lake, and Kolkata.✅ Ready-to-Move-in Flats: Legal Pros & ConsA ready-to-move-in flat is one where construction is completed, possession is granted, and the buyer can immediately shift in or start renting it out.Legal Advantages of Ready-to-Move Properties1. Clear Title & Immediate PossessionYou get to verify the actual property ownership, completion certificate, occupancy certificate, and municipal approvals.No uncertainty over possession timelines.2. No GSTAs per current tax laws, GST is not applicable on ready-to-move properties that have received Completion Certificate (CC).3. What You See Is What You GetThe buyer can physically inspect the flat, locality, and building condition—making legal verification easier.4. Easier to Conduct Legal Due DiligenceYour lawyer can perform a property title search, verify the chain of ownership, check mutation, and confirm that the flat is free from encumbrances.Legal Disadvantages of Ready-to-Move Properties1. Higher CostPer square foot prices are typically 10–20% higher than under-construction properties.2. Risk of Illegal ConstructionMany “ready” flats, especially in developing zones like New Town and Rajarhat, are illegally built without proper sanction plans. Without legal verification, you risk demolition or penalties.3. No Time to Rectify Legal IrregularitiesOnce you purchase, any pending litigation, land disputes, or illegalities become your burden.🏗️ Under-Construction Flats: Legal Pros & ConsAn under-construction property is still being developed and usually offers staged payment plans and relatively affordable pricing.Legal Advantages of Under-Construction Properties1. Lower Cost with FlexibilityPrice per square foot is often lower, especially during pre-launch stages.Payment plans are staggered across construction milestones, helping with financial planning.2. RERA Registration is MandatoryBuilders must register under RERA (Real Estate Regulation and Development Act). This adds a layer of transparency and legal protection for the buyer.3. Scope for CustomisationBuyers may request minor changes in layout, flooring, or fittings during the construction phase.Legal Disadvantages of Under-Construction Properties1. Possession Delay RiskDespite RERA, delays of 1–2 years are still common, especially in West Bengal where monitoring is lax.2. Developer Fraud or AbandonmentNumerous cases in New Town and Salt Lake Extension areas involve builders collecting funds but failing to deliver.📌 Example: A 2022 Calcutta High Court case involved a Rajarhat builder promising possession within 24 months but defaulting for over 5 years. Buyers had to litigate for refund and interest.3. Hidden Encumbrances on LandBuilders may start projects on land that is disputed, mortgaged, or under acquisition. Without legal due diligence, the buyer’s money is at risk.4. GST Applies5% GST is applicable (without Input Tax Credit) for under-construction flats, adding to the total cost.What Legal Due Diligence Must Be Done—For Both TypesWhether buying ready or under-construction property, the following legal checks are essential:For Ready-to-Move FlatsTitle search report (at least last 30 years)Occupancy Certificate (OC)Completion Certificate (CC)Mutation & Property Tax clearanceChain of documents (including Sale Deed, Conveyance, etc.)Verification of No Dues from Society or BuilderEncumbrance CertificateFor Under-Construction FlatsRERA Registration Number & StatusSanctioned Building PlanCommencement CertificateLand Title Report (verify if land is freehold, residential, and owned by builder)Development Agreement and Power of Attorney of builderAgreement for Sale vetted by legal expertsHow Our Law Firm Can HelpAt KHA ADVOCATES, we’ve assisted hundreds of NRI and first-time buyers in verifying and registering properties across Kolkata. Our services include:1. Property Title VerificationGet a comprehensive title search report with legal opinion—ensuring you don’t invest in disputed or encumbered flats.2. Agreement Drafting & ReviewWe vet or draft Agreement for Sale, Sale Deed, or Builder-Buyer Agreement to protect your interests.3. RERA Compliance & Builder Due DiligenceWe check the track record, RERA filings, and legal standing of the builder and construction status.4. Property Registration SupportOur team handles property registration, stamp duty calculation, and sub-registrar office coordination on your behalf—even without your physical presence.Conclusion: Choose Wisely, LegallyThe choice between ready-to-move and under-construction properties must balance your budget, timeline, and risk appetite. But one thing is non-negotiable—legal due diligence.In Kolkata’s fast-growing property landscape, especially in New Town, Rajarhat, and Salt Lake, blind trust on builders can cost you lakhs. But with the right legal partner, you buy safely, confidently, and profitably.📞Need Legal Help Before Buying a Flat in Kolkata?👉 Book a consultation with our real estate legal experts👉 Call us at 94-777-5-888-5👉 WhatsApp us at 8101-555-666👉 Email: contact@khaadvocates.in👉 Visit: www.khaadvocates.com

Read More