Published on: May 25, 2025

🏗️ Introduction

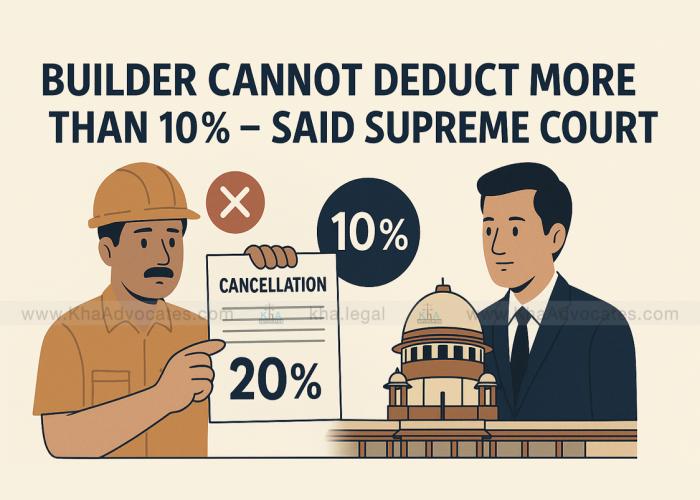

In a landmark decision that strengthens consumer rights, the Supreme Court of India has ruled that builders cannot deduct more than 10% of the total flat cost when a buyer cancels the booking. The judgment comes as a relief to countless homebuyers who have faced unfair deductions from real estate developers during cancellations. This ruling sets a powerful precedent and aligns with the principles of fairness and reasonableness under Indian contract and consumer protection law.

Over the years, many homebuyers have reported instances where real estate developers deducted 20%, 25%, or even 30% of the total property value when a buyer decided to cancel the booking, often without starting construction or incurring any loss.

This unfair trade practice prompted legal intervention, and the judiciary has now taken a stand to protect buyers from arbitrary contract clauses that are heavily biased in favour of builders.

Supreme Court Ruling: Key Highlights

In the case of Wg. Cdr. Arifur Rahman Khan & Ors. v. DLF Southern Homes Pvt. Ltd., the Supreme Court upheld the consumer-friendly interpretation that if the builder has not incurred a substantial loss or started construction, they cannot deduct more than 10% of the booking amount or flat price.

Important Takeaways:

Maximum Deduction Limit: Builders can deduct no more than 10% in case of cancellation.

Beyond 10% is arbitrary and amounts to unjust enrichment.

Unilateral terms in builder-buyer agreements that allow excessive deductions are unconscionable and voidable.

The builder cannot use delay tactics or unjust contract terms to deny fair refunds.

The Court based its ruling on several legal principles:

Principle of Unconscionable Contracts

When one party (the builder) has excessive bargaining power, the Court can strike down oppressive terms.

Citing Central Inland Water Transport Corporation v. Brojo Nath, the Court emphasized that contractual terms must be reasonable and fair.

Consumer Protection Act

The Court reaffirmed that a buyer is a consumer and entitled to just treatment under Sections 2(1)(d) & 2(1)(r) of the Consumer Protection Act.

Builders indulging in excessive deduction are guilty of unfair trade practices.

Doctrine of Reasonableness

Builders are not permitted to make windfall gains from cancellations.

Refund policy must reflect actual losses, not speculative penalties.

The Court held that forfeiture of earnest money is only valid if the party has suffered a loss. Builders must prove actual damage for withholding more than 10%.

Only reasonable forfeiture is allowed. Excessive deduction without justification is illegal.

The buyer is entitled to full refund with interest if the builder fails to deliver on time. Deductions exceeding 10% are in direct conflict with RERA’s spirit.

If you have cancelled your flat booking and the builder is withholding more than 10%, you have a strong legal remedy. The following steps are advised:

Send a legal notice seeking full refund minus 10%.

File a complaint with the Real Estate Regulatory Authority (RERA).

Approach Consumer Court if builder refuses or delays refund.

Maintain booking receipts, payment records, and correspondence as evidence.

Read the Builder-Buyer Agreement thoroughly before signing.

Negotiate clauses related to cancellation and refund.

Prefer builders registered under RERA with transparent refund policies.

Get legal vetting of the agreement from a property lawyer.

At KHA Advocates, we assist homebuyers in fighting against builder malpractices, securing rightful refunds, and filing RERA and consumer complaints. Our team of real estate and litigation experts ensures your legal rights are protected.

📞 Book a Consultation: https://khaadvocates.com/book-consultation

🏢 Representing clients in Supreme Court, High Courts, RERA & Consumer Forums

The Supreme Court’s ruling offers much-needed relief and clarity to homebuyers. By capping the builder’s deduction at 10%, the Court has reaffirmed the principle that contracts cannot override fairness and public interest. Homebuyers must remain informed, vigilant, and assertive in asserting their rights.