Legal documentation services include drafting, reviewing, and notarizing contracts, agreements, wills, deeds, affidavits, and business documents to ensure compliance with Indian laws and safeguard clients’ personal, property, and commercial interests.

Open Consultation Form.

Fill and Submit the Form.

Consult with Expert Lawyer

Submit Documents.

Business Registration/Licensing Done

Dive into our blog for the latest insights, tips, and trends. Stay informed and inspired by our expert articles on various topics that matter to you.

🔹 IntroductionBuying property in New Town, Kolkata is a dream for many. But property registration is not just paperwork — it’s a legal safeguard that determines whether your investment is truly secure. A single mistake can cost you ownership rights, money, and years in court battles.👉 This is why you need a Property Registration Lawyer — to make sure your purchase is legally valid, dispute-free, and future-proof.🔹 What is Property Registration?📖 Under the Registration Act, 1908, property transactions above ₹100 must be registered.📌 Registration = official proof of ownership.📌 Without registration = property has no legal value.In West Bengal, registration also requires compliance with the Stamp Act & Registration Rules.⚠️ Problems Buyers Face Without a Lawyer🚫 Fake/forged documents from sellers🚫 Property under litigation or mortgage🚫 Wrong calculation of stamp duty → penalties🚫 Poorly drafted Sale Deed favoring seller🚫 Encroachment & ownership disputes👉 Solution: Hire a lawyer for due diligence + drafting + registration.🔹 How a Property Registration Lawyer Helps YouA Property Registration Lawyer provides end-to-end support in:a) Title Verification & Due DiligenceChecking original ownership documents (deed, khatian, mutation, tax receipts).Ensuring the property is free from litigation, mortgage, or encumbrance.Searching records at the Sub-Registrar’s office.b) Drafting & Reviewing the Sale DeedCustomizing clauses to protect the buyer’s rights.Ensuring there is no vague language that may favor the seller.Including indemnity clauses against future disputes.c) Stamp Duty & RegistrationCorrectly calculating stamp duty and fees under West Bengal Stamp Act.Filing the necessary documents with the Sub-Registrar.d) Execution & HandoverEnsuring smooth registration before the registering officer.Obtaining the certified copy of the registered deed.Advising on mutation and municipal tax transfer post-registration.Let's Summarise for you ✅ Title Verification – checks deeds, khatian, mutation, encumbrances✅ Drafting Sale Deed – buyer-friendly clauses, indemnity terms✅ Stamp Duty & Fees – accurate calculation under WB law✅ Registration Process – smooth execution at Sub-Registrar’s office✅ Post-registration – mutation, tax transfer, possession⚖️ Case Laws You Must KnowSuraj Lamp & Industries v. State of Haryana (2011) – Only a registered deed transfers ownership.K.B. Saha & Sons v. Development Consultant Ltd. (2008) – Unregistered documents = no legal proof of ownership.👉 Moral: Without proper legal registration, you don’t own the property.🏙️ Why Special Care in New Town, Kolkata?Most properties in New Town are leasehold under HIDCO.⚠️ Risks:Government permission needed for transferLease restrictions applyWrong drafting = cancellation of allotment👉 Only a lawyer experienced in HIDCO leasehold rules can protect you.✅ How We Help at KHA Advocates🔹 Title search + due diligence🔹 Custom deed drafting🔹 Registration at Sub-Registrar’s office🔹 NRI buyer assistance via Power of Attorney🔹 Post-registration services (mutation, tax, possession)💡 We make property registration 100% safe, legal, and stress-free.❓ FAQsQ1: Is a lawyer mandatory for property registration?➡ No, but without one, you risk fraud & defective deeds.Q2: Can NRIs register without visiting India?➡ Yes, via Power of Attorney.Q3: How long does registration take?➡ 2–4 weeks depending on clearances.📞 Contact Us TodayDon’t risk your dream home or investment. Protect it with expert legal help.📲 Call: (+91) 94-777-5-888-5📲 WhatsApp: (+91) 8101-555-666📧 Email: contact@khaadvocates.in🌐 Website: www.khaadvocates.com🔗 Book Appointment: https://khaadvocates.com/book-consultationProperty registration is the foundation of ownership. In places like New Town, Kolkata, where leasehold rules make transactions tricky, hiring a Property Registration Lawyer ensures your investment is safe, legal, and hassle-free.👉 Choose smart. Choose legal security. Choose KHA Advocates.

Read More

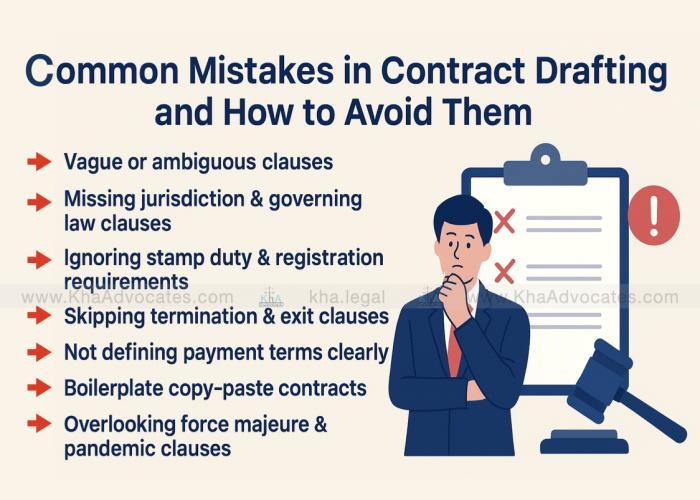

IntroductionContracts are the backbone of every business relationship. Whether you’re a startup signing your first vendor agreement or a corporation negotiating a multi-crore deal, a poorly drafted contract can lead to disputes, losses, and even litigation. In India, contract drafting is governed primarily by the Indian Contract Act, 1872, along with provisions of the Indian Stamp Act, 1899, and relevant judgments by the Supreme Court and High Courts.In this blog, we’ll explore the most common mistakes made during contract drafting, legal consequences, landmark judgments, and practical tips on how to avoid them.1. Vague or Ambiguous ClausesMistake: Using unclear terms such as “reasonable time,” “best efforts,” or “mutual understanding.”Consequence: Leads to multiple interpretations and disputes.Case Law: ONGC v. Saw Pipes Ltd. (2003) – The Supreme Court held that vague clauses can render contracts unenforceable if they lack certainty.Solution: Always use precise, measurable language. For example, instead of “deliver goods on time,” specify “deliver 500 units within 30 days.”2. Missing Jurisdiction & Governing Law ClausesMistake: Failing to specify which court or state laws will govern disputes.Consequence: Parties may file cases in multiple jurisdictions, leading to unnecessary litigation.Case Law: Swastik Gases Pvt. Ltd. v. Indian Oil Corporation Ltd. (2013) – The Supreme Court emphasized the importance of jurisdiction clauses.Solution: Insert a clear clause like: “This Agreement shall be governed by the laws of India, and courts at Kolkata shall have exclusive jurisdiction.”3. Ignoring Stamp Duty & Registration RequirementsMistake: Contracts like leases, partnerships, or property agreements often remain unstamped or unregistered.Consequence: Courts may refuse to admit such documents as evidence.Law: Indian Stamp Act, 1899 and Registration Act, 1908.Example: An unstamped lease deed exceeding 12 months can be declared invalid.Solution: Always calculate proper stamp duty and register agreements wherever required.4. Skipping Termination & Exit ClausesMistake: Not defining conditions for termination or exit of parties.Consequence: Leads to endless disputes when parties want to exit.Case Law: Tata Consultancy Services Ltd. v. Cyrus Investments Pvt. Ltd. (2021) – The importance of clear exit clauses in shareholder agreements was highlighted.Solution: Define termination events (breach, insolvency, force majeure) and lay down notice periods, penalties, and handover procedures.5. Not Defining Payment Terms ClearlyMistake: Contracts state “payment shall be made promptly” without defining mode, due date, or late fee.Consequence: Disputes over payment delays and penalties.Law: Indian Contract Act, 1872 (Section 73 – Compensation for Breach of Contract).Solution: Specify “Payment of ₹10,00,000 shall be made via bank transfer within 15 days of invoice, with 12% interest applicable on delays.”6. Boilerplate Copy-Paste Contracts Mistake: Using internet templates without customization.Consequence: Many clauses may be irrelevant, illegal, or contradictory.Case Study: A startup copied an NDA template online, which did not comply with Indian law. During litigation, the court rejected parts of the NDA.Solution: Always customize contracts based on Indian law, industry, and party requirements.7. Overlooking Force Majeure & Pandemic ClausesMistake: Not including provisions for unforeseen events like pandemics, wars, or natural disasters.Case Law: Halliburton Offshore Services v. Vedanta Ltd. (2020, Delhi HC) – The court recognized COVID-19 as a force majeure event.Solution: Define force majeure events, notification timelines, and consequences (suspension or termination).Practical Tips for Safe Contract DraftingHire a Lawyer: Professional vetting prevents loopholes.Review Twice: Both parties should review drafts carefully.Update Regularly: Revise old contracts to include latest laws and judgments.Use Clear Language: Avoid jargon, keep it simple.FAQs on Contract DraftingQ1. Is an oral contract valid in India?Yes, oral contracts are valid under the Indian Contract Act, 1872, but difficult to prove in court. Always prefer written contracts.Q2. What makes a contract legally enforceable in India?Offer, acceptance, lawful consideration, free consent, lawful object, and capacity of parties.Q3. Can a contract be on plain paper without stamp duty?Yes, it’s valid but may not be admissible in court without proper stamping.Q4. What happens if a contract has a missing clause?Courts may interpret it against the drafter, leading to unfavorable judgments.Q5. How can startups ensure safe contract drafting?By consulting a corporate lawyer to draft customized agreements like Founders’ Agreement, Shareholders’ Agreement, and Employment Contracts.Q6. Do contracts need witnesses?Not always. Only certain agreements like property deeds, wills, or surety bonds need attestation.Q7. Can e-contracts and digital signatures be used in India?Yes, under the Information Technology Act, 2000, e-signatures and e-contracts are legally valid.At KHA Advocates, we specialize in contract drafting, vetting, and negotiation for startups, corporates, and individuals. Our expert lawyers ensure your agreements are legally enforceable, customized to your needs, and dispute-proof.👉 Avoid costly litigation – Book a consultation with KHA Advocates today!

Read More

IntroductionBuying a property—especially for NRIs or first-time buyers in West Bengal—is often seen as a milestone achievement. However, what’s not visible in glossy brochures and site visits are the hidden charges that can inflate your cost by lakhs. Whether you’re eyeing a premium flat in Salt Lake or an investment property in Durgapur, knowing what lies beneath the surface is crucial to avoid legal and financial pitfalls.At KHA ADVOCATES, we’ve helped hundreds of clients legally uncover and prevent hidden property costs through rigorous legal due diligence, title search, and registration support.⚠️ Common Hidden Charges Most Buyers Overlook1. Legal Scrutiny & Title Due Diligence (Or Lack Thereof)Builders often charge legal processing fees, but these do not include independent title verification. Many NRIs assume the property is “clear,” only to later face disputes.Real Case: A buyer in New Town discovered, post-payment, that the property was under litigation despite having paid legal fees to the builder.✔️ Solution: Always appoint your own property lawyer for due diligence.2. GST on Under-Construction PropertyAs per current law, under-construction properties attract 5% GST (without ITC), while ready-to-move flats are exempt if the completion certificate is received.💡 Tip: Ask for the CC or OC (Occupancy Certificate) to avoid unnecessary tax burdens.3. Car Parking ChargesParking isn’t “free.” Many builders in Kolkata and Salt Lake charge ₹2–6 lakhs for open or covered parking, despite Supreme Court rulings stating parking cannot be sold separately from the flat.📜 Case Reference: Nahalchand Laloochand Pvt Ltd v. Panchali Co-op Housing Society Ltd – SC held that open parking cannot be sold as an independent unit.4. Clubhouse & Maintenance DepositsThese are often presented vaguely as “amenities charges.” In gated communities, builders demand 1–3 years of advance maintenance and non-refundable clubhouse development fees.✔️ Ask for a breakup of maintenance charges and get it in writing.5. Advance Registration ChargesSome developers insist on upfront registration payments. But beware—many delay handing over sale deeds or register in builder’s name first, forcing resale to buyer with double registration fee.✔️ Registration should only happen after OC/CC and full payment clearance.6. Hidden Floor Rise ChargesEven within the same building, rates differ per floor. Builders in Durgapur, Salt Lake, and Alipore may add ₹20–₹100/sqft for “floor rise” without disclosing this early.7. PLC – Preferential Location ChargesCorner flats, park-facing units, or east-facing homes may have added costs. These are negotiable but often hidden until agreement.✔️ Ask early about PLCs. Always include a clause to limit variation in final price.8. Delayed Possession Penalties SkippedAgreements often don’t mention compensation if possession is delayed. Or worse, they include one-sided clauses favoring the builder.📜 RERA mandates a fixed timeline and penalty for delay under West Bengal Housing Industry Regulation Act (WBHIRA).Legal Checklist to Avoid Hidden Charges✅ StepWhat You Must Check🔍 Title VerificationIndependent search of 30+ years of ownership📜 Agreement ClausesClear breakup of GST, PLC, parking, and maintenance🏗️ RERA RegistrationEnsure property is registered on WBHIRA portal🧾 All-Inclusive QuotationAvoid “base price” traps—ask for final cost🖋️ Builder-Buyer AgreementLegally vetted, RERA-compliant contract🧑⚖️ Legal OpinionHire a property lawyer—not builder’s panel advocatePros and Cons: Ready-to-Move vs Under-Construction in West BengalFeatureReady-to-MoveUnder-ConstructionGST✅ No GST❌ 5% GST (no ITC)Hidden ChargesFewerMany (Amenities, Floor rise, PLC)Risk of DelayMinimalHigh without strong contractRegistration TimelineImmediatePost-completionLegal SecurityHighMedium (depends on due diligence)Real-Life Case Study – How Legal Help Saved a Homebuyer ₹5.5 LakhsA client from Baharampur booked a flat in Chinsurah and was asked to pay ₹3 lakhs as “advance clubhouse charges” and ₹2.5 lakhs for “parking rights.” Our legal team reviewed the documents and found both charges illegal under WBHIRA and Supreme Court guidelines. After a formal notice, the builder dropped all additional demands.✔️ Result: Buyer saved ₹5.5 lakhs and got clean registration within 30 days.Frequently Asked Questions (FAQs)Q1: Can I refuse to pay parking charges to a builder?Yes, especially if it’s for open parking. Covered parking may be charged nominally but must be included in the sale agreement.Q2: Are these hidden charges legal under RERA/WBHIRA?No. Builders are mandated to disclose all charges up front. Any deviation can be challenged before the WBHIRA authority.Q3: What if the builder delays possession after I’ve paid full amount?Under RERA, you’re entitled to interest compensation or withdrawal with refund. Get a lawyer to enforce this through legal notice or complaint.Why Choose KHA ADVOCATES?Whether you are an NRI, first-time buyer, or investor, our legal team offers:✅ Title Verification & Search Report (30+ Years)✅ Sale Agreement & Deed Drafting✅ Builder-Buyer Agreement Vetting✅ Registration Support across West Bengal✅ RERA Dispute Handling & Legal NoticesWe’ve helped over 100 clients across New Town, Kolkata, Hooghly, Siliguri, and Durgapur avoid hidden traps and legally secure their investment.ConclusionHidden charges aren’t just financial nuisances—they can become legal nightmares. If you’re buying a property in New Town, Salt Lake, Baharampur, or anywhere in West Bengal, make sure your investment is protected with the right legal guidance.Ready to Buy Property in West Bengal?📞 Book a Legal Consultation with KHA ADVOCATES👉 Call us now : 94-777-5-888-5👉 WhatsApp: 8101-555-666👉 Email us: contact@khaadvocates.in👉 Visit: www.khaadvocates.com

Read More

IntroductionBuying a flat is a milestone. But a critical question arises for every buyer:Should you go for a ready-to-move-in flat or an under-construction property?While both options come with distinct advantages, the legal implications, risks, and due diligence steps differ drastically. This blog breaks down the legal pros and cons of both choices—especially for first-time home buyers, real estate investors, and NRIs planning to invest in areas like New Town, Salt Lake, and Kolkata.✅ Ready-to-Move-in Flats: Legal Pros & ConsA ready-to-move-in flat is one where construction is completed, possession is granted, and the buyer can immediately shift in or start renting it out.Legal Advantages of Ready-to-Move Properties1. Clear Title & Immediate PossessionYou get to verify the actual property ownership, completion certificate, occupancy certificate, and municipal approvals.No uncertainty over possession timelines.2. No GSTAs per current tax laws, GST is not applicable on ready-to-move properties that have received Completion Certificate (CC).3. What You See Is What You GetThe buyer can physically inspect the flat, locality, and building condition—making legal verification easier.4. Easier to Conduct Legal Due DiligenceYour lawyer can perform a property title search, verify the chain of ownership, check mutation, and confirm that the flat is free from encumbrances.Legal Disadvantages of Ready-to-Move Properties1. Higher CostPer square foot prices are typically 10–20% higher than under-construction properties.2. Risk of Illegal ConstructionMany “ready” flats, especially in developing zones like New Town and Rajarhat, are illegally built without proper sanction plans. Without legal verification, you risk demolition or penalties.3. No Time to Rectify Legal IrregularitiesOnce you purchase, any pending litigation, land disputes, or illegalities become your burden.🏗️ Under-Construction Flats: Legal Pros & ConsAn under-construction property is still being developed and usually offers staged payment plans and relatively affordable pricing.Legal Advantages of Under-Construction Properties1. Lower Cost with FlexibilityPrice per square foot is often lower, especially during pre-launch stages.Payment plans are staggered across construction milestones, helping with financial planning.2. RERA Registration is MandatoryBuilders must register under RERA (Real Estate Regulation and Development Act). This adds a layer of transparency and legal protection for the buyer.3. Scope for CustomisationBuyers may request minor changes in layout, flooring, or fittings during the construction phase.Legal Disadvantages of Under-Construction Properties1. Possession Delay RiskDespite RERA, delays of 1–2 years are still common, especially in West Bengal where monitoring is lax.2. Developer Fraud or AbandonmentNumerous cases in New Town and Salt Lake Extension areas involve builders collecting funds but failing to deliver.📌 Example: A 2022 Calcutta High Court case involved a Rajarhat builder promising possession within 24 months but defaulting for over 5 years. Buyers had to litigate for refund and interest.3. Hidden Encumbrances on LandBuilders may start projects on land that is disputed, mortgaged, or under acquisition. Without legal due diligence, the buyer’s money is at risk.4. GST Applies5% GST is applicable (without Input Tax Credit) for under-construction flats, adding to the total cost.What Legal Due Diligence Must Be Done—For Both TypesWhether buying ready or under-construction property, the following legal checks are essential:For Ready-to-Move FlatsTitle search report (at least last 30 years)Occupancy Certificate (OC)Completion Certificate (CC)Mutation & Property Tax clearanceChain of documents (including Sale Deed, Conveyance, etc.)Verification of No Dues from Society or BuilderEncumbrance CertificateFor Under-Construction FlatsRERA Registration Number & StatusSanctioned Building PlanCommencement CertificateLand Title Report (verify if land is freehold, residential, and owned by builder)Development Agreement and Power of Attorney of builderAgreement for Sale vetted by legal expertsHow Our Law Firm Can HelpAt KHA ADVOCATES, we’ve assisted hundreds of NRI and first-time buyers in verifying and registering properties across Kolkata. Our services include:1. Property Title VerificationGet a comprehensive title search report with legal opinion—ensuring you don’t invest in disputed or encumbered flats.2. Agreement Drafting & ReviewWe vet or draft Agreement for Sale, Sale Deed, or Builder-Buyer Agreement to protect your interests.3. RERA Compliance & Builder Due DiligenceWe check the track record, RERA filings, and legal standing of the builder and construction status.4. Property Registration SupportOur team handles property registration, stamp duty calculation, and sub-registrar office coordination on your behalf—even without your physical presence.Conclusion: Choose Wisely, LegallyThe choice between ready-to-move and under-construction properties must balance your budget, timeline, and risk appetite. But one thing is non-negotiable—legal due diligence.In Kolkata’s fast-growing property landscape, especially in New Town, Rajarhat, and Salt Lake, blind trust on builders can cost you lakhs. But with the right legal partner, you buy safely, confidently, and profitably.📞Need Legal Help Before Buying a Flat in Kolkata?👉 Book a consultation with our real estate legal experts👉 Call us at 94-777-5-888-5👉 WhatsApp us at 8101-555-666👉 Email: contact@khaadvocates.in👉 Visit: www.khaadvocates.com

Read More

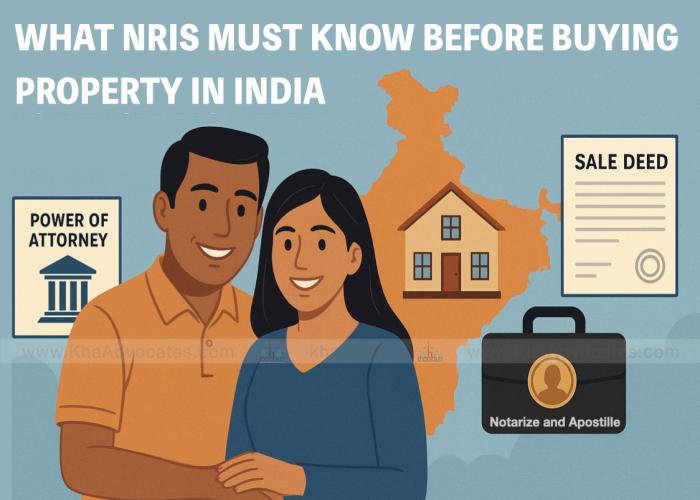

India has always been an attractive destination for Non-Resident Indians (NRIs) looking to invest in property—whether it’s a flat in the heart of Mumbai, a villa in Goa, or a retirement home in their hometown. With a booming real estate market and emotional ties to the homeland, it’s no surprise that thousands of NRIs buy properties in India every year.But here’s the catch: buying property in India as an NRI involves legal complexities that must be carefully handled to avoid risks like title disputes, fraud, or procedural delays. The good news? With the right legal team and planning, you can invest in Indian real estate without even flying down.This guide walks you through everything NRIs must know before buying property in India—especially about Power of Attorney, Sale Deed registration remotely, and how to ensure a safe and legally compliant transaction.Who Can Buy Property in India as an NRI?As per FEMA (Foreign Exchange Management Act) regulations, NRIs and PIOs (Persons of Indian Origin) can buy:Residential properties (flats, houses, plots)Commercial propertiesHowever, agricultural land, plantation property, or farmhouses cannot be purchased by NRIs without special permission from the RBI.Must-Have Documents Before You ProceedTo start the process, make sure you have the following ready:Indian Passport or OCI CardPAN Card (mandatory for property transactions)Address Proof (local and overseas)Recent photographsNRE/NRO Bank Account for financial transactionsPower of Attorney (if you cannot travel to India)Power of Attorney (PoA): Your Legal Key When You’re AbroadIf you are not physically present in India to oversee the purchase, the Power of Attorney (PoA) is your best legal solution. It allows a trusted person—usually a relative, friend, or lawyer—to act on your behalf.Types of PoA You Can Use:General Power of Attorney: Broad powers for managing or selling property.Special Power of Attorney: Limited to specific acts like signing a sale deed, submitting documents, etc.How to Execute a PoA from Abroad:Draft the PoA: Work with an Indian legal expert to draft a PoA customized to your transaction.Notarize and Apostille it in your country of residence (as per Hague Convention rules).Send it to India via post or courier.Adjudicate the PoA at the local Sub-Registrar Office in India within 90 days of receipt.Legal Tip: Always specify exact powers and property details to prevent misuse.Can NRIs Register Property in India Without Visiting?Yes. NRIs can register the Sale Deed remotely through their attorney holder, provided the PoA includes registration rights.Here’s how it works:Execute a registered Sale Agreement.PoA-holder attends the Sub-Registrar Office for Sale Deed registration.All payments (including stamp duty and registration charges) are made from the NRI’s NRE/NRO account.This process ensures complete compliance while saving you travel expenses and time.Legal Checks Before You BuyTitle VerificationEnsure the property title is clear, marketable, and free from encumbrances. Your legal team should:Verify ownership documentsCheck the mutation recordsReview past Sale DeedsConduct searches in the Registrar’s OfficeBuilder or Seller Due DiligenceIf you’re buying from a developer, check:RERA registrationLand ownership documentsApprovals from local authoritiesFor resale properties:Identity and ownership of the sellerEncumbrance Certificate for last 30 yearsDues (property tax, society dues, utility bills)Stamp Duty & Tax ComplianceNRIs must pay applicable stamp duty and registration charges, and ensure:TDS (Tax Deducted at Source) is deducted as per Indian Income Tax ActPAN is linked and updatedCapital Gains implications are understoodWe assist NRIs in full tax compliance and documentation from start to finish.Online Property Services Now Available for NRIsIndian states like Maharashtra, West Bengal, Karnataka, and Delhi have digitized large parts of the property registration and land records system.Services you can access online:Property title searchSale Agreement draftingPoA processingOnline submission of documentsMutation applicationWith the right law firm, everything from property search to final registration can be done virtually.Real Case Example: How KHA ADVOCATES Helped an NRI Buy a Flat in Kolkata Without Visiting Indiafew of our NRI client from the UK, US, Australia wanted to purchase a resale flats in New Town, Rajarhat, Salt Lake, Kolkata. they executed a Special Power of Attorney, got it apostilled, and sent it to us. We verified the title, negotiated with the seller, executed the Sale Agreement, paid stamp duty, and registered the deed—all within 45 days.He didn’t have to step foot in India—and yet, the entire transaction was legally compliant and fully secure.Want to Buy Property in India Without Hassles?At KHA ADVOCATES, we specialize in end-to-end property legal services for NRIs, including:Power of Attorney drafting and adjudicationProperty title search & verificationSale Deed preparation & registrationMutation and name transferProperty tax and legal due diligenceWhether you’re buying a new home, resale property, or investing in a commercial space, our NRI Property Legal Team ensures a smooth and legally secure transaction—without you having to travel to India.📞 Let’s TalkIf you’re an NRI planning to buy property in India, don’t take chances. Talk to our legal experts, Book Consultation today.✅ Call Now: +91-94777-58885🌐 Visit: www.khaadvocates.com📧 Email: contact@khaadvocates.inSecure Your Dream Property in India—Without the Stress.Partner with the experts in NRI Property Law.This article is published by KHA ADVOCATES—India’s leading NRI Property Legal Advisors.

Read More

Buying a flat in Kolkata is a significant milestone—especially for first-time home buyers and NRIs looking to invest in India. With Kolkata’s real estate market expanding across locations like Rajarhat, New Town, Salt Lake, Garia, and Behala, it’s easy to get overwhelmed by the options.However, this excitement often leads to rushed decisions—and costly mistakes.At KHA ADVOCATES, we’ve helped hundreds of property buyers avoid legal traps, save lakhs in taxes, and secure their dream homes with confidence. Here’s our expert guide on the 8 most common mistakes to avoid before buying a flat in Kolkata.1. Skipping Legal Title VerificationWhy it’s a mistake:Many buyers trust the builder’s brochure or online listing without verifying the legal title of the property. Flats built on disputed, encroached, or unauthorized land can lead to years of litigation.What to do instead:Hire a qualified property lawyer in Kolkata to conduct a title search for 30+ years and verify ownership, encumbrance, mutation, and land conversion records.✅ Tip: Always ask for a lawyer-certified Title Verification Report before paying the booking amount.2. Ignoring Developer’s Credentials & Project ApprovalsWhy it’s a mistake:Even big-name builders can default. Many flats in Kolkata are sold without municipal plan sanctions, completion certificates, or RERA registration—making them legally weak.What to do instead:Ask for:Building Sanction PlanRERA Registration NumberFire & Environmental ClearancesPast Project Completion Records✅ Tip: Cross-check the developer’s RERA profile on West Bengal RERA portal.3. Not Executing a Proper Agreement for SaleWhy it’s a mistake:Verbal assurances or token money receipts are not enough. Without a registered Agreement for Sale, your rights as a buyer are legally unsecured.What to do instead:Your sale agreement must be:Drafted by your lawyer (not the builder’s)Include clauses for possession date, penalties, refund, force majeure, and exit optionsProperly stamped and registered under the Registration Act✅ Tip: Ensure all payments are linked to construction milestones, not fixed dates.4. Overlooking Property Tax, Mutation, and Utility DuesWhy it’s a mistake:Unpaid taxes and utility bills from the previous owner or builder become your liability after purchase. This also impacts future mutation or resale.What to do instead:Insist on:Property Tax Clearance Certificate (KMC/KMDA/Municipality)Electricity and Water Bill ReceiptsMutation Records from BLRO or Municipal Body✅ Tip: Ask your lawyer to conduct a due diligence report on all municipal records.5. Buying Without Checking Land Conversion & Zoning PermissionsWhy it’s a mistake:Flats built on agricultural or ceiling-surplus land are illegal and may face demolition or cancellation by government authorities.What to do instead:Your lawyer must verify:Conversion Certificate (from agricultural to residential use)Zoning Compliance under the Master PlanLand Category under the West Bengal Land Reforms Act✅ Tip: Avoid flats built on thika land, vested land, or tenanted land unless fully regularized.6. Trusting Brokers Without Legal OversightWhy it’s a mistake:Real estate agents may push for a fast deal without revealing hidden issues. Many are not legally trained to detect property frauds or incomplete approvals.What to do instead:Use brokers only for site visits or negotiations. For documentation and verification, always consult a qualified real estate lawyer.✅ Tip: KHA ADVOCATES can appoint a verified broker and negotiate directly on your behalf.7. Failing to Register the Flat ProperlyWhy it’s a mistake:Even after full payment, if the Sale Deed is not registered, you are not the legal owner. Unregistered flats can’t be mortgaged, sold, or inherited.What to do instead:Ensure that:Sale Deed is drafted by your lawyerCorrect stamp duty is calculated (with NRI/TDS considerations if applicable)Registration is done before the Sub-Registrar✅ Tip: We assist NRIs with online registration appointments, digital POA execution, and sub-registrar compliance.8. Ignoring Tax Implications and Home Loan ClausesWhy it’s a mistake:Tax defaults, wrong home loan structuring, or not availing deductions under Section 80C/24B can cost you lakhs in lost benefits or future penalties.What to do instead:Get tax planning advice for:Capital gains (if selling old property)TDS on NRI transactionsJoint ownership and HUF benefitsLoan EMI deductions✅ Tip: Ask KHA ADVOCATES for a full tax advisory before loan sanction or final registration.Conclusion: Buy Smart, Buy LegalKolkata’s flat market is booming—but smart buyers invest with legal protection.Whether you’re an NRI investing from abroad, a young couple buying your first home, or a senior citizen securing retirement property, avoiding these 8 mistakes will save you from years of legal and financial trouble.Why Choose KHA ADVOCATES?At KHA ADVOCATES, we specialize in:✅ Property Title Verification✅ Agreement & Sale Deed Drafting✅ NRI Power of Attorney & Property Registration✅ Legal Due Diligence Reports✅ Tax Planning & Home Loan Support✅ Flat Mutation & Municipal Compliance👇 Need Legal Help Before Buying a Flat in Kolkata?📞 Call us now at +91-94-777-5-888-5💬 WhatsApp: 8101-555-666📩 Email: contact@khaadvocates.in🌐 www.khaadvocates.com🔒 Book a Free 15-Minute Consultation With a Property LawyerFAQs:Q1. I live abroad. Can I buy a flat in Kolkata without coming to India?Yes, we help NRIs with Power of Attorney, digital due diligence, and end-to-end legal support.Q2. Can I verify the flat’s title before booking?Absolutely. Our Title Search Services verify 30+ years of ownership and municipal records.Q3. How much stamp duty will I pay while registering the flat?It depends on the flat value and location (KMC, Rajarhat, Howrah). Contact us for a precise calculator.

Read More

Is a Nominee the Legal Owner of Funds in a Deceased Person’s Bank Account?When a person opens a bank account, they are often asked to name a nominee. Many believe that this nominee becomes the rightful owner of the account’s funds after the account holder’s death. However, legally speaking, this understanding is incorrect. In India and many other jurisdictions, the role of a nominee is distinctly different from that of a legal heir. This article explores the legal status of a nominee, their rights, and the remedies available to legal heirs if they are wrongfully deprived.Who is a Nominee?A nominee is a person designated by the account holder to receive the funds from the account in the event of their death. This nomination is made under Section 45ZA of the Banking Regulation Act, 1949 and Rule 2(1) of the Banking Companies (Nomination) Rules, 1985. The purpose of appointing a nominee is to enable the bank to discharge its liability quickly and without requiring legal formalities such as a succession certificate or probate.Key Point: A nominee is merely a trustee, not the owner of the funds.Legal Position of a Nominee vs. Legal HeirsSeveral landmark court judgments have clarified the distinction between nominees and legal heirs. The most notable is the Supreme Court ruling in Sarbati Devi v. Usha Devi (1984 AIR 346) which stated that the nominee is merely a trustee for the legal heirs.In the context of bank accounts, the nominee holds the funds in trust for the legal heirs unless the nominee is also a legal heir. If the deceased has written a will, the distribution of the funds must follow the instructions in the will. If there is no will, the assets are distributed according to the personal law applicable to the deceased (e.g., Hindu Succession Act, Muslim Personal Law, Indian Succession Act, etc.).Supreme Court JudgmentsSarbati Devi vs. Usha Devi (1984) – Held that nomination does not override succession laws; the legal heirs are entitled to the funds.Ramanathan vs. State Bank of India (2006) – Reinforced that the nominee is only a trustee for the legal heirs.Shakti Yezdani v. Jayanand Jayant Salgaonkar (2017, SC) – Held that nomination under the Companies Act and banking law does not override the succession rights of legal heirs.Thus, nomination ensures smooth transfer from the bank’s side but does not confer legal ownership.Bank’s ResponsibilityBanks are not responsible for verifying the rightful heir before releasing the funds to a nominee. Their legal obligation ends once the money is handed over to the nominee. It is up to the legal heirs to claim their rightful share from the nominee if they believe they have been wrongfully excluded.When a Nominee Deprives Legal Heirs: What is the Remedy?If a nominee refuses to share the funds with the rightful heirs, legal action can be taken. The following remedies are available:1. Civil Suit for RecoveryLegal heirs can file a civil suit for recovery of their share in the funds. The suit should be supported by succession documents, such as a will, legal heir certificate, or succession certificate.2. Probate or Letters of AdministrationIf there is a will, it should be probated (where required) to establish the rights of the heirs. In the absence of a will, a court may grant letters of administration to distribute the estate as per applicable succession laws.3. Injunction OrdersCourts can also grant injunctions to prevent the nominee from withdrawing or utilizing the funds until rightful ownership is determined.4. Mediation or Family SettlementIn cases involving family disputes, mediation can help arrive at a mutually agreeable settlement without prolonged litigation.Legal Heirs’ Rights Over Bank FundsUpon the death of the account holder, succession laws come into play.Applicable Succession Laws:Hindu Succession Act, 1956 (for Hindus, Sikhs, Jains, Buddhists)Muslim Personal Law (Shariah) (for Muslims)Indian Succession Act, 1925 (for Christians and others)If a will exists, the executor must distribute the estate as per its terms. If the deceased died intestate (without a will), the property is distributed among Class I heirs, which usually include:SpouseChildrenMotherOther direct descendantsA nominee cannot override these rights.Best Practices to Avoid DisputesMake a Will: Ensure your intentions are clearly mentioned in a registered will.Appoint the Right Nominee: Preferably appoint a nominee who is also a legal heir.Inform Family Members: Make your heirs aware of your nomination and estate planning.ConclusionA nominee does not automatically become the owner of funds in a deceased person’s bank account. Instead, the nominee acts as a custodian until the legal heirs claim their rightful share. Misconceptions around nomination often lead to disputes. Understanding the legal framework and taking proper estate planning measures can prevent conflict and ensure smooth transmission of assets.Want to know more about your legal rights as an heir?Visit 👉 www.KhaAdvocates.com or book a consultation now.

Read More

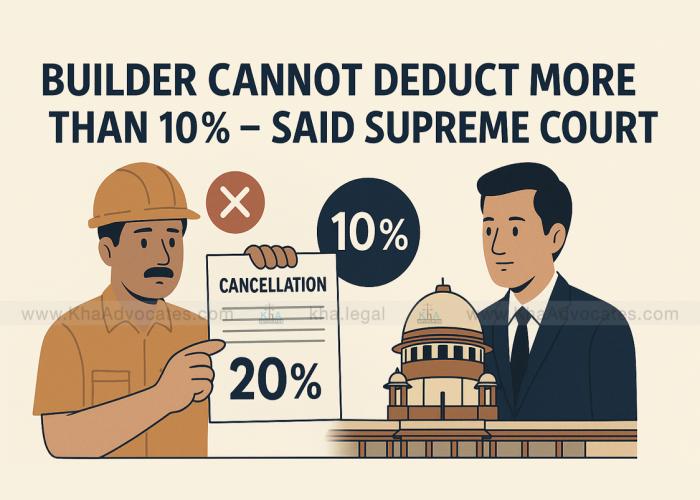

🏗️ IntroductionIn a landmark decision that strengthens consumer rights, the Supreme Court of India has ruled that builders cannot deduct more than 10% of the total flat cost when a buyer cancels the booking. The judgment comes as a relief to countless homebuyers who have faced unfair deductions from real estate developers during cancellations. This ruling sets a powerful precedent and aligns with the principles of fairness and reasonableness under Indian contract and consumer protection law.Background: Why This Issue MattersOver the years, many homebuyers have reported instances where real estate developers deducted 20%, 25%, or even 30% of the total property value when a buyer decided to cancel the booking, often without starting construction or incurring any loss.This unfair trade practice prompted legal intervention, and the judiciary has now taken a stand to protect buyers from arbitrary contract clauses that are heavily biased in favour of builders.Supreme Court Ruling: Key HighlightsIn the case of Wg. Cdr. Arifur Rahman Khan & Ors. v. DLF Southern Homes Pvt. Ltd., the Supreme Court upheld the consumer-friendly interpretation that if the builder has not incurred a substantial loss or started construction, they cannot deduct more than 10% of the booking amount or flat price.Important Takeaways:Maximum Deduction Limit: Builders can deduct no more than 10% in case of cancellation.Beyond 10% is arbitrary and amounts to unjust enrichment.Unilateral terms in builder-buyer agreements that allow excessive deductions are unconscionable and voidable.The builder cannot use delay tactics or unjust contract terms to deny fair refunds.⚖️ Legal Reasoning: Supreme Court’s AnalysisThe Court based its ruling on several legal principles:Principle of Unconscionable ContractsWhen one party (the builder) has excessive bargaining power, the Court can strike down oppressive terms.Citing Central Inland Water Transport Corporation v. Brojo Nath, the Court emphasized that contractual terms must be reasonable and fair.Consumer Protection ActThe Court reaffirmed that a buyer is a consumer and entitled to just treatment under Sections 2(1)(d) & 2(1)(r) of the Consumer Protection Act.Builders indulging in excessive deduction are guilty of unfair trade practices.Doctrine of ReasonablenessBuilders are not permitted to make windfall gains from cancellations.Refund policy must reflect actual losses, not speculative penalties.Other Important Judgments on the SubjectKailash Nath Associates v. DDA [(2015) 4 SCC 136]The Court held that forfeiture of earnest money is only valid if the party has suffered a loss. Builders must prove actual damage for withholding more than 10%.Haryana Urban Development Authority v. Dropadi DeviOnly reasonable forfeiture is allowed. Excessive deduction without justification is illegal.RERA Provisions – Section 18 of RERA Act, 2016The buyer is entitled to full refund with interest if the builder fails to deliver on time. Deductions exceeding 10% are in direct conflict with RERA’s spirit.What It Means for HomebuyersIf you have cancelled your flat booking and the builder is withholding more than 10%, you have a strong legal remedy. The following steps are advised:📋 What You Can Do:Send a legal notice seeking full refund minus 10%.File a complaint with the Real Estate Regulatory Authority (RERA).Approach Consumer Court if builder refuses or delays refund.Maintain booking receipts, payment records, and correspondence as evidence.Precautionary Measures for Future BuyersRead the Builder-Buyer Agreement thoroughly before signing.Negotiate clauses related to cancellation and refund.Prefer builders registered under RERA with transparent refund policies.Get legal vetting of the agreement from a property lawyer.How KHA Advocates Can HelpAt KHA Advocates, we assist homebuyers in fighting against builder malpractices, securing rightful refunds, and filing RERA and consumer complaints. Our team of real estate and litigation experts ensures your legal rights are protected.📞 Book a Consultation: https://khaadvocates.com/book-consultation🏢 Representing clients in Supreme Court, High Courts, RERA & Consumer ForumsConclusionThe Supreme Court’s ruling offers much-needed relief and clarity to homebuyers. By capping the builder’s deduction at 10%, the Court has reaffirmed the principle that contracts cannot override fairness and public interest. Homebuyers must remain informed, vigilant, and assertive in asserting their rights.

Read More.jpeg)

Mutual consent divorce is often considered the least acrimonious way for a couple to end their marriage. But even in such consensual separations, financial matters—particularly maintenance and alimony—remain crucial. Whether you’re the spouse seeking support or the one expected to provide it, knowing your legal rights under Indian law is essential.In this comprehensive guide, we will cover:What is mutual divorce under Indian law?Meaning and types of alimony/maintenanceLegal provisions under Section 125 CrPC, Hindu Marriage Act, Special Marriage ActKey Supreme Court judgments and their analysisTaxability and enforceabilityStrategic legal tips for NRIs and women seeking maintenanceWhat Is Mutual Divorce?Mutual divorce in India is governed by Section 13B of the Hindu Marriage Act, 1955 (for Hindus) and Section 28 of the Special Marriage Act, 1954 (for inter-religious couples). The key requirement is that both spouses agree to end the marriage and have been living separately for at least one year.In such cases, financial arrangements such as maintenance or alimony must be mutually settled—preferably through written agreement—before filing the second motion petition in court.What Is Alimony and Maintenance?Although often used interchangeably, alimony and maintenance have distinct legal meanings:Maintenance is regular financial support—monthly or periodic payments—to the spouse who is unable to support themselves.Alimony is typically a one-time lump sum settlement paid at the time of divorce.These financial obligations are not limited to wives. Husbands can also claim maintenance under certain legal circumstances.Relevant Legal Provisions in IndiaSection 125 of the Criminal Procedure Code (CrPC)Provides for monthly maintenance to wives (including divorced wives), children, and parents who are unable to maintain themselves.Section 24 & 25 of the Hindu Marriage Act, 1955Section 24 allows either spouse to claim maintenance during the pendency of proceedings.Section 25 enables permanent alimony after the divorce.Section 36 & 37 of the Special Marriage Act, 1954Equivalent provisions applicable to inter-faith or civil marriages.Muslim Women (Protection of Rights on Divorce) Act, 1986Special provision for divorced Muslim women, including rights to mehr, maintenance, and provision during iddat.⚖️ Supreme Court Judgments on Maintenance & Alimony1. Rajnesh v. Neha (2020) 14 SCC 324Facts: Husband delayed paying maintenance; interim relief was contested.Ruling:The Supreme Court issued comprehensive guidelines on maintenance and alimony, including:Standardized affidavit formats to declare income/assetsTimelines for interim and final maintenanceAvoidance of multiplicity of proceedings across courtsImpact: This case became a landmark for procedural clarity in maintenance matters.2. Bhuwan Mohan Singh v. Meena (2015) 6 SCC 353Observation:“Right to maintenance is a facet of human rights and the constitutional guarantee under Article 21.”Analysis:This judgment emphasized the urgency of providing timely financial relief to the dependent spouse and condemned procedural delays.3. Kalyan Dey Chowdhury v. Rita Dey Chowdhury (2017) 14 SCC 200Ruling:Maintenance should not exceed 25% of the husband’s net salary in most cases, unless special circumstances exist.Significance:This became a benchmark ratio for calculating monthly support, especially in metro cities.Maintenance in Mutual Divorce AgreementsIn mutual divorce, spouses often opt for a one-time full and final settlement, waiving future claims. The settlement must:Be reasonable and not against public policyBe recorded in the divorce petition and decreeNot be vague or conditionalTip: Always include a clause regarding non-revision and enforcement of alimony through execution petitions, if unpaid.Can Maintenance Be Claimed After Mutual Divorce?Yes, if no maintenance was agreed or mentioned in the mutual consent decree, the wife (or husband) can later file a petition under Section 125 CrPC or other applicable laws.However, if the decree clearly states that maintenance has been paid in full, such claims may not stand unless:There was fraud/coercionThe spouse later becomes destituteNRI Marriages and Maintenance: What You Need to KnowNRIs (Non-Resident Indians) seeking or defending mutual divorce should consider:Jurisdiction of Indian family courts for maintenance claimsEnforceability of Indian maintenance orders abroadProvisional seizure of foreign assets in maintenance defaultIndian courts can issue Look-Out Circulars (LOCs) and seize passports for non-compliance.Is Alimony Taxable in India?Monthly maintenance received is taxable in the hands of the recipient under “Income from Other Sources.”Lump-sum alimony is generally not taxable as per judicial interpretation (subject to evolving Finance Acts).The payer cannot claim a tax deduction for maintenance.Important TakeawaysPointExplanation🔍 Who Can Claim?Either spouse under CrPC, HMA, SMA📆 When to File?During or after mutual divorce💡 Court PowersModify, enhance, or reduce amount🛑 Can It Be Waived?Yes, in mutual settlement, if fairly negotiated🚫 Penalty for Non-paymentAttachment of salary/assets, arrestConclusionMaintenance and alimony are not just financial settlements—they are legal rights rooted in dignity and equality. Even in mutual divorces, it’s critical that financial security, especially for the non-earning spouse, is not compromised under emotional pressure.To ensure that your mutual divorce agreement is legally enforceable, tax-efficient, and future-proof, always consult an experienced family law advocate.📞 Need Help with Mutual Divorce or Alimony Claims?KHA ADVOCATES has decades of experience in mutual divorce, NRI matrimonial disputes, and alimony settlement negotiations. We represent clients across the Supreme Court, High Courts, and Family Courts in India.🔗 Visit www.KhaAdvocates.com📩 Book a Confidential Legal Consultation Today!

Read More

KHA ADVOCATES brings deep knowledge and hands-on experience in company law, commercial law, and regulatory frameworks, ensuring reliable legal counsel.

We offer tailor-made legal strategies suited to startups, SMEs, and large corporations, addressing your unique business goals and challenges.

Our client-centric approach ensures honest advice, timely execution, and complete transparency throughout the process.

Whether you're in tech, real estate, manufacturing, finance, healthcare, or international trade, we understand the specific legal requirements and compliance needs of each sector.

KHA ADVOCATES is also known for assisting startups and early-stage ventures with legal incorporation, investor term sheets, founders' agreements, and ESOP structuring.

We offer flexible fee structures, retainers, and project-based billing suitable for businesses of all sizes — with scalable legal services as you grow.

A: Legal documentation refers to the preparation, drafting, and validation of documents such as contracts, deeds, agreements, affidavits, and other legal instruments that define rights, obligations, or transactions under the law.

Need legal documents drafted? Contact our expert legal drafting team today.

A: Proper legal documentation ensures enforceability, clarity of terms, and protection of your legal rights. It minimizes disputes and serves as critical evidence in case of future conflicts.

Secure your legal rights—schedule a consultation for custom legal documents.

A: We draft a wide range of documents including sale deeds, lease agreements, wills, gift deeds, power of attorney, contracts, MoUs, NDAs, employment agreements, and trust deeds.

Tell us your requirement—we’ll draft it precisely for you.

A: Yes, a lawyer ensures your contract is legally sound, customized, and enforceable, while protecting you from vague terms and future liabilities.

Book a drafting session with our contract law specialists today.

A: Costs vary based on document type, complexity, and required notarization or registration. We offer transparent, competitive pricing tailored to your needs.

Get a free quote—send us your documentation request now.

A: Absolutely. We offer 100% digital legal documentation services—consultation, drafting, and delivery—especially convenient for NRIs and remote clients.

Get your documents prepared from anywhere in the world.

A: We collect details of the buyer, seller, property, and transaction terms, draft the deed as per applicable laws, and assist with stamp duty and registration formalities.

Let our property law experts prepare your sale deed hassle-free.

A: Share your asset list and distribution wishes with us, and we’ll draft a legally binding Will that reflects your intent clearly and securely.

Protect your legacy—get your Will drafted by our experts today.

A: Notarization validates the authenticity of a document and its signatories, making it admissible in court and preventing fraud or tampering.

Need a notarized document? Walk in or get it done remotely with us.

A: Most standard agreements are drafted within 24–72 hours. Complex documents may take longer based on the clauses and parties involved.

Urgent documentation? Ask about our express drafting services.

A: Yes, our law firm offers end-to-end legal documentation services for NRIs, including virtual consultations, online drafting, e-signing assistance, notarization, and courier of signed documents worldwide.

Serving NRIs in 23+ countries—start your documentation process now.

A: A Power of Attorney (PoA) authorizes someone to act on your behalf for property, finance, or legal matters. It is crucial for NRIs to manage assets or court matters in India.

Draft your General or Special Power of Attorney with our expert team.

A: A PoA can be revoked by executing a Deed of Revocation and notifying the concerned parties, registrar, and attorney-in-fact, especially in writing and through public notice.

Need to revoke your Power of Attorney? Get a legally sound deed now.

A: You need identity proofs of donor and donee, PAN cards, property documents, draft of the Gift Deed, photographs, and applicable stamp duty payment.

Register your Gift Deed confidently—consult our property documentation experts.

A: Yes, we specialize in drafting and registering residential, commercial, and long-term lease deeds with legally enforceable clauses tailored to your needs.

Avoid rental disputes—get your lease deed drafted by professionals.

A: A lease creates an interest in property with exclusive possession, while a license grants only permission to use without transferring rights. Both require specific legal language.

Confused about lease vs. license? Let our experts guide you.

A: You provide details like firm name, partners, capital ratio, profit-sharing, duties, etc. We draft the deed and assist with registration under the Indian Partnership Act.

Start your business partnership on a strong legal foundation—get your deed now.

A: Yes, we prepare customized employment agreements, covering roles, duties, remuneration, confidentiality, non-compete, and termination clauses as per Indian labor laws.

Hire with confidence—get employment contracts tailored to your business.

A: You’ll need a Trust Deed, ID/address proofs of settlor and trustees, passport-size photos, property documents (if applicable), and stamp duty per state law.

Build your legacy—register your trust with our legal support.

A: An MoU is a written understanding between two or more parties outlining mutual goals or intentions. Though not always legally binding, it provides clarity before formal agreements.

Need a business MoU? Get one drafted by professionals today.

A: To make an MoU legally binding, include clear terms, signatories’ consent, legal consideration, intention to create legal relations, and execute it on stamp paper if required.

Secure your business deals—consult us for a binding MoU today.

A: A MoU outlines mutual intent without legal enforceability, whereas an Agreement is a legally binding document with obligations, rights, and remedies under contract law.

Unsure whether to use an MoU or Agreement? We’ll help you decide.

A: Yes, but modifications must be made through an Addendum or Supplementary Agreement, signed by all parties, and sometimes re-registered or notarized if required by law.

Need changes in your signed documents? Let us do it right.

A: We assess the confidential elements, parties involved, purpose, and duration, and then draft the NDA to ensure your business information stays protected.

Protect your business secrets—get a legally sound NDA today.

A: No, Will registration is not mandatory under Indian law. However, a registered Will carries greater evidentiary value and prevents disputes during probate.

Want peace of mind? Let us help you register your Will.

A: A valid Will must be made by a sound-minded adult, in writing, signed by the testator and two witnesses. Registration and medical fitness certificate are optional but helpful.

Protect your family’s future—draft your Will with us today.

A: Yes, we provide property title search, title report preparation, and legal vetting of deeds, ensuring clean ownership and risk-free transactions for NRIs and residents.

Buying property? Ensure title clarity with our expert legal check.

A: The cost depends on property value, complexity of terms, and jurisdiction. We offer fixed, transparent pricing for drafting and reviewing property Sale Agreements.

Get a professionally drafted Sale Agreement—reach out for pricing.

A: Key clauses include property description, consideration amount, payment terms, possession date, seller’s title, indemnity, and registration. We customize every clause to safeguard your interests.

Ensure your sale deed protects your investment—let our lawyers draft it.

A: A legally enforceable contract must have lawful purpose, mutual consent, consideration, legal capacity, and should avoid ambiguity or illegal terms. Legal vetting is crucial.

Don’t risk vague contracts—get expert legal review today.

A: Yes, we draft legal documents in English, Hindi, and Bengali to ensure clarity, enforceability, and compliance with local jurisdictional requirements.

Get your documents drafted in your preferred language—contact us today.

A: Absolutely. Our legal experts provide thorough vetting of contracts, agreements, deeds, and other documents to identify risks, loopholes, and ensure compliance.

Submit your documents for legal review and peace of mind.

A: A legal notice is a formal written communication demanding action or warning of legal steps. It is typically used in disputes before initiating litigation.

Need to send a legal notice? Let our lawyers draft it for you.

A: Yes. NRIs can execute PoAs abroad and use them in India after proper attestation and authentication as per MEA and Indian consulate guidelines.

NRI? Manage legal matters in India through a valid PoA—ask us how.

A: A Shareholder Agreement governs the rights, obligations, and protections of shareholders in a company. It’s vital for startups and businesses with multiple investors.

Secure your business interests—get a custom Shareholder Agreement today.

A: We draft loan agreements with clear terms on loan amount, repayment, interest, security, default clauses, and legal remedies, ensuring enforceability.

Avoid future disputes—let us draft your loan agreement professionally.

A: While not mandatory, legal assistance ensures correct drafting, stamp duty calculation, witness formalities, and proper registration—reducing errors and future legal risks.

Let professionals handle your registration—book a legal consultation today.

A: An Indemnity Bond is a legal promise to compensate for any loss or damage arising from specific actions or omissions. It’s common in financial and property transactions.

Need an Indemnity Bond drafted? We’ll take care of the legalities.

A: Document registration generally takes 1–3 working days, depending on the Registrar’s schedule, document type, and completeness of paperwork.

Speed up your registration—let our legal team handle the process.

A: NRIs can send us scanned documents via email, attend video consultations, and receive couriered drafts and originals. We assist with attestation, e-signing, and remote POA too.

No matter where you are, your documentation is just a call away.

Highly recommended for Divorce case. I got Divorce order so fast than my expectation. Thanks a lot Mr. Kabir

Shreyasi Chakrabarty